|

Dear

Reader,

Welcome to the 7th edition of my weekly

BullCharts software Tip Sheets, focussing on tips and hints relating to

the use of the Australian BullCharts charting software package.

I need to keep this week's Tip Sheet short, because of some tight time

frames. I have only recently finished the January edition of Brainy's

monthly e-Newsletter articles, so I have little time left for this

week's Tip Sheet.

In the January edition e-Newsletter articles I covered the following

topics:

- BullCharts Backup and Restore feature -

why? how? where?

- Share Trading - exactly what is a

company's share actually worth? How do you find out?

- Technical Analysis - Support and

Resistance - including trendlines (which are actually support or

resistance lines), and overhead resistance.

If you are a subscriber to my monthly e-Newsletters, then you already

have access to this material. You can see a preview of the articles

(the first page of each of the four 4-page articles), or consider

subscribing. Click here for more details about Brainy's

Monthly eNewsletter articles (on Technical Analysis, Share Trading and

BullCharts).

Please feel free to send me feedback, or

requests for additional topics .

Topics in this week's Tip Sheet: |

|

|

Index

for the Tip Sheets Archive

BullCharts

Backup and Restore

Lines

(and trendlines) on charts

BullCharts

HELP for Trendlines

BullCharts

"Snap to Data"

More

information

This

TipSheet might look strange?

|

| BullCharts Backup and Restore |

|

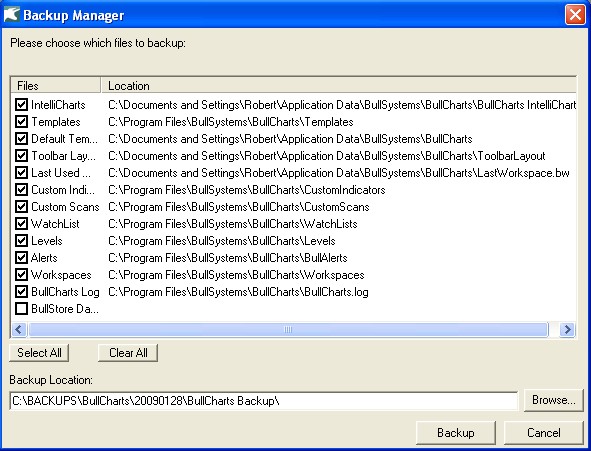

There is a very useful backup and restore feature

in BullCharts (since version 3.6).

Why would you want to use this feature? Well there are a couple of

reasons, the most obvious one of which is just in case something

happens to your files, and you need to reinstate them. Which files? For

a hint, see the screen shot here (click on it to see a larger view).

The worst possible situation would be if your computer was stolen (or

the house burns down, heaven forbid). In a situation like this, could

you manage without your computer and the software? You can easily

reinstall the software, but any data or files that you customised

yourself would be gone.

Of course, you should already have in place a Disaster Recovery Plan

(DRP), or at least a Business Continuity Plan (BCP). You might think

that these are only for large businesses, but they are also very useful

for individual traders. More on this topic in another one of Brainy's

eNewsletter articles soon.

Alternatively, you might have a desktop PC in the home/office, and a

laptop for use on the road. It is possible that the software license

might permit you to have BullCharts installed onto both computers. If

so, how can you keep the various files and data synchronised across

both computers? One way is to take a backup from one computer, copy the

backup files to the other and restore them.

One very useful feature of BullCharts is that many "things" are stored

in separate discrete files, and not all lumped up into a database, or

into a master file. So the BullCharts backup feature provides lots of

flexibility.

In this month's e-Newsletter article (available to subscribers) we take

a look at the various BullCharts files that exist, and which could be

backed up for restoring later; and we look at the various backup and

restore options, and how to do it.

|

| Lines (and trendlines) on charts |

|

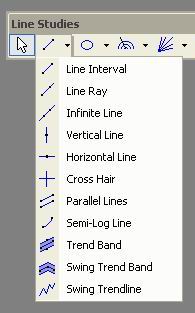

One of the BullCharts tools that many people would

be familiar with is the selection of lines that are available on the

Line Studies Toolbar. The first button on that toolbar has as many as

11 buttons to draw a range of different "lines" on the price chart. See

the accompanying screen shot for the list.

The most common of these would have to be any of the first 3, to draw a

straight line on the chart - as in a trendline. Remember to draw an

uptrend line under a rising price (indicating

support of the price), and a downtrend line above a

falling price (indicating a ceiling resistance line stopping the price

from rising).

Also, a trend line needs to touch at least 2 points on the price chart

to indicate a valid trend. Three points is better.

Some people believe that if the price touches the trend line even more

than this, then it is starting to indicate possible weakening of the

support/resistance line, and a potential break through it.

One option on these first three lines is to "Snap to Data". More on

this in another next section below.

And there is more information on Support and Resistance in the Third

(January) edition of Brainy's monthly e-newsletters (available to

subscribers). Click here for more details.

|

| BullCharts HELP for Trendlines |

|

|

The BullCharts software includes a good Help

facility. With BullCharts running, just hit the F1 function key. See

the accompanying screen shot here (click on it for a larger view).

To see more information in the online Help on the various Line Studies

toolbar buttons for trend lines (all those shown in the screen shot

further above), click on the "Search" tab in the BullCharts Help, then

in the "...keyword to find" field type in trendlines

and either hit the Enter key, or click on the "List Topics" button.

In the displayed list of search results (under the heading "Select

Topic to Display"), scroll down the list to the "Trendlines" entry and

either double-click on it, or click on it once to select it and click

on the "Display" button.

You can then scroll down through the displayed material for more

details about these toolbar options.

|

| BullCharts "Snap to Data" |

|

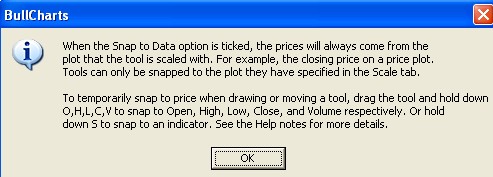

When you draw these lines on a price chart, there

is an option to "snap to data". But there are a couple of ways you can

use this feature.

Firstly, draw the line on the chart.

Now you can right-click on the line and click on "Snap to data" from

the drop-down menu list. This will snap the two "handles" of the line

to the price data (actually to the Close price). You can then adjust

the location of the line by clicking on one of the handles on the line

and dragging it sideways. But while the "Snap to data" option is on,

the handle will always lock onto a Close price.

Or, you can right-click on the line and select "Properties" from the

drop-down menu list. In the "Properties" dialogue box, click on the

"Parameters" tab, and notice the check box to the right - "Snap to

data" - which has a link under it that says "Learn more". If you click

on this link you will see the dialogue that is displayed in the

accompanying screen shot to this article above (and you can click on it

to view a larger image).

NOTE the second half of the

text in this dialogue box, about "temporarily snap to price...". By

using the O, H, L, C keys while you move a line's handle, you can snap

a line's handle to any one of a candle's Open, High, Low, or Close

price points. The detailed sequence of steps to snap to a price High

(for example) are as follows:

- Draw the line on the price chart in the

normal way, in roughly the right location.

- Use the mouse left-click to grab

one of the line's handles.

- Drag this handle across the chart

until it is on the desired candle.

- Keep holding the left mouse button

down.

- Now just tap a key on the keyboard

- the letter O for Open, H for High, etc. (note that "tap" the keyboard

means to hit the letter on the keyboard and release - a quick tap).

- Now release the mouse button.

|

| More information |

|

|

More details on some of the topics in these Weekly

Tip Sheets are included in Brainy's Monthly eNewsletters that

are available to subscribers (for a very modest amount). Feel free to

click on the relevant link at right to view samples and more details.

These weekly Tip Sheets for BullCharts* users are intended to be short,

quick grabs of information. They are not a replacement for the monthly

detailed Brainy's eNewsletter articles, which cover these same topics

but in much more detail. The eNewsletters articles also cover Technical

Analysis and Share Trading topics.

Also see the BullCharts on-line help (in BullCharts, hit the F1 key),

and the relevant User Guide Chapter for more details (this is supplied

with the software and copied to your hard drive as a PDF file).

Note: Any screen shots shown in this newsletter are snapped from

BullCharts version 3.8 (which will be available very soon).

FEEDBACK? - I am very keen to receive feedback about these weekly

BullCharts Tipsheets. Please feel free to email me with comments, or

suggestions.

* - BullCharts is: "...an

innovative charting and technical analysis system. It provides a

feature rich and powerful set of tools with access to the latest

strategies from local and overseas authors in analysing the dynamics of

the stock market."

|

| This TipSheet might look strange? |

|

|

This TipSheet has been composed in HTML and

distributed using an online service, and is intended to be viewed in

HTML (ie. web language) format. Some parts might look a little strange,

especially if you are viewing a basically text-only version. I am

working on a text-only version.

We have also found that some web-mail clients (eg. Hotmail and Yahoo

mail) can mess up some aspects.

Please feel free to send me feedback if

anything looks strange.

|

|

|

Index for the Tip Sheets Archive

|

|

|

|

Now that I have a few Tip Sheets

produced, and available from my online Tip Sheet archive, it will be

useful to have an index so that we can all find relevant information

quickly and easily.

So I have now put up a web page that contains just an index of the Tip

Sheet topics. A quick cropped screen shot of the page is shown above,

and you can click on the link to go to that

page.

I will update the page each week to include new material as it is

produced.

|

|