More

Information

For more information and downloadable information sheets

on this topic, see:

Robert writes information from time to time

about the market and investing. If you are not a

Toolbox Member, you can register

to receive useful free information as it is

published.

Privacy ensured, unsubscribe anytime.

See

the

Testimonials - the things that people say

about the Toolbox and more.

|

The

Share Market - more information about the market

and investing and trading.

The toolbox is an arsenal of weapons to help you tackle

the share market.

See a list of contents on

the Toolbox

Gateway

page.

Robert Brain provides

various support to both new and experienced traders and

investors.

Who is Robert Brain?

And whatever you do,

beware of the sharks

in the ocean!

|

Your stock universe - A guide to selecting investment stocks

When investing (or trading) in shares in any share market, there

are many to choose from. In the Australian share market

alone, there are more than 2000 equities to choose from -

including both companies and ETFs. So how can you decide

which of these to invest in? Across all of the available

equities, there are a number of different characteristics which

might help you to make your decisions.

Many investors and traders will firstly compile a list of

equities which they will call their own "stock universe". Then

they will make a selection from that list based on a variety of

other criteria. The important point here is that having compiled

a "stock universe" list, they will tend to ignore any equities

that are not on the list.

By compiling such a list, it will simplify the investment

decision process, and help to reduce some of the distractions

that can cause confusion.

Stock selection - two step process

Many investors and traders will do two things:

- One or more "stock

universe" lists - Prepare a list of their own

"stock universe". But they might have more than one list, in

which case there would be a strategy that describes how to

use each list. For example, one list of speculative stocks

might be traded with just a small portion of the investment

capital, while another list of large-cap blue chip stocks

might be used for longer term and more stable investment

returns.

- Separate strategies

- Have a strategy that describes exactly how an investment

would be made in a stock within the stock universe. Each

stock universe would potentially have a separate strategy to

guide the investment.

WHY bother to prepare a "stock universe" list?

Many investors and traders don't prepare a stock universe list.

They simply look across all stocks in the market, and apply a

filter (one or more filters) to produce a list of investment

candidates. If you do work through the process of preparing a

list, then you will probably find the following advantages:

- It will help you to stay focused on the investing/trading

activities.

- It will be easier to prepare a trading/investing plan to

is suitable for a specific stock universe, because the

strategy might be a little different for a different stock

universe.

- It will help to avoid distractions. Many investors/traders

are happy to read the latest news and announcements about

their "favourite" stocks. But if we invest in potentially

any stock in the market, then there is too much news to

read. By having a stock universe, it will help us to decide

which news to read, and which news to skip over.

What if I don't prepare a "stock universe" list?

It's quite okay if you don't prepare a "stock universe" list.

You can still search through the whole market for

investing/trading candidates. And you might be distracted by

stocks that don't really fit your stock criteria. That's okay.

Some people would say that this is not the smartest way to

operate. But you will probably end up at about the same

end-point.

HOW to compile your own "stock universe" list:

So, how do we compile our own "stock universe" list? Here are

some considerations for investing in equity markets around the

world. The "stock universe" might simply be any one of the

following:

- Large-caps - The

stocks in a particular large-cap index (eg. in the US

market, perhaps the S&P500 index).

- Mid-caps -

A selection of mid-cap stocks.

- Small cap stocks -

Smaller cap stocks (eg. in the US market, the stocks in the

Russell 2000 index).

- Sector specific -

The stocks in a particular market sector (eg. Health Care,

or Technology), or make a conscious decision to ignore the

stocks in a particular market sector (eg. Materials, or

Energy sectors).

- A manual selection of

stocks based on market cap - This can be done using

appropriate stock

selection tools (more notes below).

- Stock liquidity -

You might choose to invest (or trade) only in liquid stocks.

That is, the stocks that have enough turn over on the market

each day so as to increase your chances of getting into a

position, or exiting one, quickly and without moving the

market. See a discussion

about Stock Liquidity. This topic is also to with Risk and Money

Management.

If focusing only on the Australian market, then the following

considerations might be useful:

- The so-called "top 200" stocks - the XJO index

(S&P/ASX 200).

- The so-called "top 500" stocks - the XAO index.

- The stocks in the mid-cap 50 index (XMD).

- The stocks in the Small Ordinaries index (S&P/ASX

XSO).

Some considerations to help you decide

When giving some thought to this topic, the following

considerations might help:

- Blue chip stocks:

- Many investors think that they would like to invest in

blue chips stocks. That is a good aspiration.

- However, there is no clear definition of the term blue

chip, and therefore there is no list of blue chip stocks

to work from.

- See the latest definition of the term

blue chip at the ASX website, and note that this

definition wording has changed a couple of times since the

GFC in 2008.

- Any broker or financial advisor that has a list of blue

chip stocks is using their own criteria to compile the

list.

- In truth, at various stages of the economic cycle, blue chips can

disappoint.

- If you are looking for a definitive list of blue chip

stocks, then good luck.

- Large cap stocks:

- These tend to have a market capitalisation in the order

of $10 billion or more (subject to change).

- These are analysed by the research analysts, and

recommended by the brokers.

- There tend to be many buy/hold/sell recommendations for

these stocks

- Of the 2000+ stocks on the Australian market, only a

small number of them are large cap stocks and watched by

the research analysts. The conclusions and recommendations

of the research analysts do influence the opinions and

purchase decisions of many investors. You might choose to

consciously follow the crowd and consider their views, or

you might decide to avoid these stocks.

- The Australian XTL index (S&P/ASX 20) comprises just

20 large cap stocks.

- Small cap stocks:

- These tend to have a market capitalisation in the order

between about $300 million and about $2

billion (subject to change).

- The companies that are considered to be small cap

stocks, tend not to be watched by research analysts, nor

recommended by lots of brokers. You might decide to ignore

these, or to follow these stocks.

- Small cap stocks tend to be less liquid than the larger

cap stocks. So be careful about the stock liquidity.

- Mid-cap stocks:

- These tend to have a market capitalisation in the order

between about $1 billion and $5 billion (subject to

change).

- This category comprises stocks that have a market

capitalisation in between the large cap category and the

small cap category.

- These stocks tend to be less well followed by analysts

and brokers. You might like this idea, or not like it.

- Micro cap stocks:

- These tend to have a market capitalisation in the order

between about $50 million and about $300

million (subject to change).

- Micro cap stocks have an even smaller market

capitalisation than the small cap stocks, and are often

even less liquid than the small cap stocks.

- These stocks tend to have even smaller share price

values, which can be volatile.

- Low share prices ("penny

dreadfuls")

- The share prices of companies (on the Australian market)

can vary from as high as $100+ all the way down to less

than 1 cent (ie. to fractions of a cent). The stocks with

a share price of just a few cents or less are often

referred to as the "penny dreadfuls" of the market. The

penny dreadfuls do not usually include any blue

chip stocks, so some people avoid them.

- It is true to say that share prices above about $10 are

unlikely to double or triple in price, whereas share

prices of less than a dollar or so can double in price.

You might decide to have one strategy that focuses on low

share prices (these stocks can be riskier), as opposed to

focusing on the higher priced shares.

- Fundamental metrics

- Debt to equity ratio - Companies with a debt to equity

ratio of about 50 percent or more are more likely to be

stressed when the economic cycle turns and it is harder to

borrow funds to finance company operations. So choosing

companies with a low debt to equity ratio can mitigate

this risk.

- Liquidity

- The notion of stock

liquidity is important for a couple of reasons.

- Hundreds of stocks on the Australian market have very

low daily trades,

and/or low daily volume

or turn-over.

- Without realising it, many investors eventually exclude

illiquid stocks from their stock universe at some stage

during the daily or weekly search for stocks.

- Many investors and traders will filter their list

of investment candidates to exclude the stocks with a very

low level of liquidity.

- See more

information about stock liquidity.

- Sectors:

- You might have a view that info-tech stocks are likely

to have the best candidates at the current point in time.

So you might choose to focus on the stocks within the

info-tech sector. Likewise, for the healthcare sector, or

one of the other sectors.

- Some investors consider some types of sectors to be "old

world" as opposed to "new world". For instance, the

technology sector stocks are considered to be companies

that are more likely to be more valuable in the long term.

This notion is discussed in Nicholas Darvas's book "How I

Made $2,000,000 in the Stock Market".

- Here is one key point to bear in mind about sectors. The

sector indexes (eg. XIJ, XHJ, etc.) are only comprised of

stocks from the XJO (S&P/ASX 200) index. If you want

to know what other stocks across the market are considered

to be in the same GICS sector, then you will need to look

at a list of stocks grouped by GICS industry group code. See more

about the GICS coding system.

- See

more information about the Australian market

sectors, including downloadable

information sheets.

How do the above market indexes relate to each other? Is any one

of them included within another? See

Robert's Index Composition handout.

Stock selection tools

So how do you actually go about compiling a useful stock

universe list? Many investors/traders will maintain a list of

their favourite stocks (their stock universe) as one or more

watch lists in their computer software - either with their

online broker, or in their chosen software package. It is quite

alright to have more than one stock universe, depending on your

investing strategy.

The range of available tools includes:

- Search tools available with your online broker.

- Free web-based search tools at various websites.

- Charting and technical analysis software tools - such as BullCharts.

Some more tips

Here are a few tips about how to find stocks in a particular

category like those described above:

For

stocks of a particular range in market cap, use your

charting software to do a search* (in BullCharts, one of the

140 supplied scans is in the "Fundamental" category, to scan

by Market Cap). For

stocks of a particular range in market cap, use your

charting software to do a search* (in BullCharts, one of the

140 supplied scans is in the "Fundamental" category, to scan

by Market Cap).- For the stocks in a particular sector, view

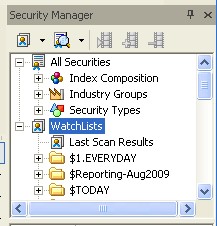

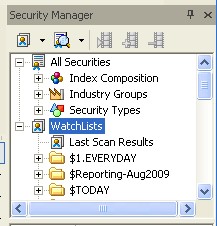

the "Index Composition" section in Security Manager in

BullCharts*. (See the screen shot at right)

- For the stocks in a particular GICS industry group, view

the "Industry Groups" section in Security Manager in

BullCharts*. (See the screen shot at right)

- To find out the liquidity level of various stocks, firstly

understand more about the issues to do

with liquidity, and then use a tool* to identify

the liquid stocks for inclusion in your universe, or

the illiquid stocks to exclude.

* - The Australian

BullCharts charting software is this author's preferred

tool, and can perform these searches.

More information?

See the links above right for more details.

|

For

stocks of a particular range in market cap, use your

charting software to do a search* (in BullCharts, one of the

140 supplied scans is in the "Fundamental" category, to scan

by Market Cap).

For

stocks of a particular range in market cap, use your

charting software to do a search* (in BullCharts, one of the

140 supplied scans is in the "Fundamental" category, to scan

by Market Cap).