|

Brainy's

Share Market Toolbox (public information) |

|

Intrinsic value and

|

|

A lot is said about the notion of intrinsic

value.

|

| You are here:

Share Market Toolbox

>

Share Market >

Intrinsic value and

value investing Related links: Robert's Philosophy; Share Market GEMs; Share-Market-Ready; Paper Trading; Market Indexes; Exit strategies; Stop Loss; Support and Resistance; Trend-spotting; Funda-Technical Analysis; Sensible Investing; Contrarian Investing Redefined; Technical Analysis; |

IntroductionWhat is intrinsic value? How do we calculate it? How useful is the notion of intrinsic value? Is there a better substitute? What are the alternatives? Oh, by the way, here are four sometimes interchanged terms which are very similar, but perhaps a little different: intrinsic value, fair value, fundamental value and true worth. The other issue to mention here is that many readers might read through the following material, and then choose to ignore the information because it doesn't agree with their own views. This is one of the most common forms of cognitive bias from which many investors suffer, and it is what holds back many investors from being more successful. For more details about cognitive biases and behavioural finance, see the discussion on Emotion and Psychology in the markets. Value investingThe idea of value investing is based on the notion that a security is cheaper than it should be, and that it will then appreciate to a price that reflects its worth. The truth of this in practise is that it might not happen for quite a long time, in which case the funds could have been better invested elsewhere. The other possibility is that it might never happen - there might be some other news that changes the situation completely. What if Mister Market decides the share price needs to fall? And the price falls and falls. This is capital destruction at work. Is there an alternative?Just to digress for a moment, in case you are wondering if there is an alternative, consider the following. The momentum, or trend following, strategy is based on the notion that a security's price is more likely to continue in the same direction than reverse. That is, once a price trend is in place, it is likely to continue. This is actually one of the six tenets of Dow Theory. One reason that this happens is based on the underlying emotion and psychology of the markets. Intrinsic value - a definitionInvestopedia defines intrinsic value as: The actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business, in terms of both tangible and intangible factors (source: www.investopedia.com/terms/i/intrinsicvalue.asp). Wikipedia defines intrinsic value as: In finance, intrinsic value refers to the actual value of a company or stock determined through fundamental analysis without reference to its market value. It is also frequently called fundamental value. It is ordinarily calculated by summing the future income generated by the asset, and discounting it to the present value (source: en.wikipedia.org/wiki/intrinsic_value). Intrinsic value - simplified estimateBenjamin Graham is widely acknowledged as offering a formula to determine intrinsic value. This factors in the latest EPS, plus a forward estimate of company growth (refer Wikipedia). If everybody relied on this calculation method, things would be so very straight forward. But people want an "edge" when investing in the markets. They want a better way to do a more accurate job and to be ahead of the other market participants. Intrinsic value - how to calculateA common way to determine a company's intrinsic value is to use fundamental analysis. This can involve the study of company financial reports, as published at key times throughout the company's annual financial calendar. It is also possible to factor in a study of the company's management and competitive advantages, as well as it's markets and competitors. In fact, it could include the study of anything which could impact on the viability and profitability of the company and it's performance. More specifically, one might consider any or all of the following parameters which can impact on a company's financial performance and it's intrinsic value:

|

|||||||||||

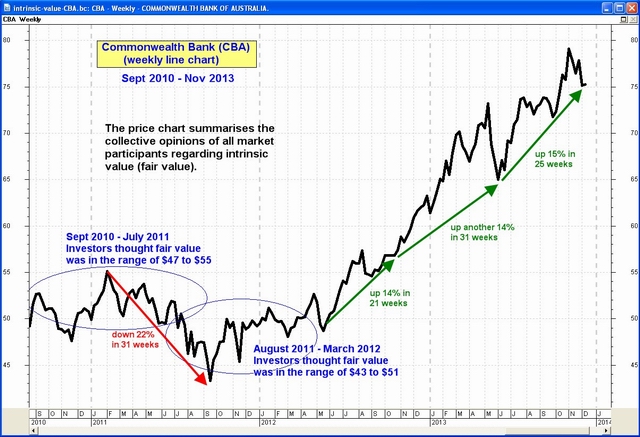

Market priceIt is worth spending a moment to think about market price. This is the amount of money that market participants are prepared to pay for a company's shares today. If anyone thinks that a company's shares are worth something quite different to the current market price, then it doesn't really matter. For example, if CBA bank shares are trading on the market for $65, and someone wants to sell their parcel at $75 each, there won't be any buyers at that price. If someone has estimated that fair value is $75, then it doesn't matter today, because no one wants to buy them at that price. Conversely, if you think that CBA is actually worth $55, and it is trading at around $65, no one will sell it to you for $55. You might want to buy it at this price, and sit and wait for it to fall to this level. But it might not come down. In fact, it might remain at it's current levels for months or years, and possibly move higher, in which case you have missed out on dividends and possible capital appreciation. Intrinsic value - the realityIf you ask a hundred brokers and analysts what they believe is a fair price for the shares of, say, Commonwealth Bank, what do you think the answer will be? How many different answers will we get? Should we consider all their recommendations and take a statistical average price, or a median price?

Now through all this time, anyone's opinion about the intrinsic value pretty much didn't matter a hoot. If you want to know what something is really worth, then sell it. It will be worth whatever the eventual buyer is prepared to pay for it. Alternative?Is there a reasonable alternative? Well, don't forget that in reality, almost everything that might influence a company's share price has already been considered by the maajority of investors, and so is already factored into the share price. That is, the share price chart captures and summarises the collective opinions of the real market participants. It is the market participants whose opinions about price are captured in the price chart. If anyone believes that a stock is "worth" something quite different to the value that it is traded for on the market, then who is right? At the end of the day, it is the so-called "Mister Market" who is right. ConclusionWhy spend all that time reviewing company performance, and studying financial results, and making assumptions to derive numbers to go into a spreadsheet model? Is it really worth the time? Well, many retail investors do this because they enjoy the activity. It's like any other hobby, or enjoyable past-time. It is often argued by some market participants that there is no need to spend so much time on very detailed analyses. Because at the end of the day, the right number for the “fair value” is the closing price on the share market today. It is futile to argue against the market. Whatever the market tells us about a share price is very close to the truth — except of course for those people with inside information and who might trade on this non-public knowledge. And the conclusion? For the absolute chartist (or technical analyst) who believes that fundamental analysis is distracting and therefore almost a total waste of time, it could be argued that paying attention to intrinsic value is a total waste of time. More informationFor more information on this and related topics, see in the column above right... |

This is one of the many tools in Brainy's Share Market Toolbox.

The information presented herein

represents the

opinions of the web page content owner, and

are not recommendations or

endorsements of any product, method, strategy, etc.

For financial advice, a professional and licensed financial advisor

should be engaged.