More Information

eBook Articles - Share Market Toolbox Members

can see more details in the following eBook Articles:

(Toolbox non-Members can see the "Page 1" of these Articles

from the Master List page.)

Robert writes information from time to time about

the market and investing. If you are not a Toolbox

Member, you can register to receive

useful free information as it is published.

Privacy ensured, unsubscribe anytime.

See

the Testimonials - the things that people say

about the Toolbox and more.

|

Terminology

Any special terms that might be used in the text at left,

can probably be found discussed in the Toolbox somewhere.

Perhaps in Brainy's eBook Articles - see the Master Index list for details.

Or, search

the eBook Articles.

The Share Market - more information

about

the market and investing and trading.

The toolbox is an arsenal of weapons to help you tackle the

share market.

See a list of contents on

the Toolbox

Gateway page.

Robert Brain provides

various support to both

new and experienced traders and investors.

Who is Robert Brain?

And whatever you do,

beware of the sharks in the ocean!

|

Stan Weinstein

Stan Weinstein published one really good text book in 1988, Secrets for Profiting in Bull and Bear

Markets, and in it he promoted a number of key

strategies and concepts.

30-week Moving Average (MA)

on a Weekly price chart

This is one of Weinstein's key principles. In the weekly chart

of the XAO above, the blue curve is the 30-week Moving Average (MA).

For as long as the price stays above the 30-week MA, and

the MA line is heading upwards, Stan says the index (or stock)

is rising. But if price crosses below the MA and the MA

flattens and heads down, then there could be rough times ahead and

it is time to sell. For example, in January 2008 and late April

2010.

Stage Analysis

The coloured ribbon across the bottom of the above chart is

Weinstein's Stage Analysis ribbon (as applied in BullCharts

charting software).

Weinstein said that at any one point in time, a stock (or an index)

will be in one of four market "stages":

- Stage 1 the Basing Area (also known as consolidation or

accumulation phase)

- Stage 2 the Advancing Stage

- Stage 3 the Top Area (also known as the distribution phase),

or

- Stage 4 the Declining Stage.

For more information about Stage Analysis, see Brainy's eBook (PDF)

Article

ST-6410, "Sample trading strategies - Weinstein"

(Toolbox Member password required), and you can refer to Weinstein's

book, "Secrets

for profiting in Bull and Bear Markets".

There is a great 6-minute interview with Stan Weinstein on YouTube

regarding his Stage Analysis. See the video on YouTube here (you might need

to persevere with or skip, some ads).

Simple MA or Weighted MA?

There is often discussion about whether Stan used a Simple, or a

Weighted, Moving Average. Here are some notes with reference to his

book.

- Page 13: "...Over the

years, I've found that a 30-week moving average (MA) is the

best one for long-term investors, while the 10-week MA is best

for traders to use. A 30-week MA is simly the closing price

for this Friday night added to the prior 29 Friday weekly

closings. Divide that figure by 30 and the answer is what's

plotted on this week's chart...".

- Page 25: "...Mansfield

charts do not give a simple 30-week MA where all 30 weeks

count equally. Instead, they use a weighted 30-week MA where

by the most recent action counts far more than the old input.

This makes the MA more sensitive to current activity and helps

it reverse direction faster. The drawback to their weighted

average is that it leads to a few more whipsaws..."

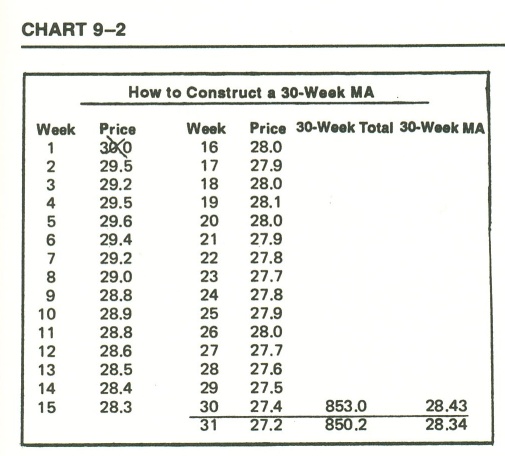

Page

313

includes the diagram labelled Chart 9-2 (shown at right), and

provides a detailed explanation of how to easily calculate a

30-week simple moving average (without a calculator or computer)

as follows: Page

313

includes the diagram labelled Chart 9-2 (shown at right), and

provides a detailed explanation of how to easily calculate a

30-week simple moving average (without a calculator or computer)

as follows:

"To get the first plot for

your 30-week MA, simply add up the 30 weeks on your calculator

or computer and get the total (853). Put that answer in the

total column. Then divide by 30 and you have your starting

point for the MA (28.43). In the following weeks, there is no

need to repeat the lengthy process of adding up the new 30

weeks. Simply add the 31st week (27.2) to last week's total,

then subtract out the oldest week (the oldest week's total in

this case is 30.0 - remember to cross it out on your data

sheet...".

Acknowledgement:- The text and table above are from Weinstein's

book.

Readers are encouraged to study further details in his book,

"Secrets

for profiting in Bull and Bear Markets" (McGraw-Hill,

1988) available from good book shops, including the Educated

Investor financial bookshop:- www.educatedinvestor.com.au

Note also that a 30-week WMA appears somewhat similar to a 20-week

or 21-week EMA.

It is also interesting to understand that Weinstein developed and

tested his approach over a long period of time, and when computers

were only scarcely available. And the computers that he might have

had ready access to were probably the text-based version (the first

incarnation of Windows was available in late 1985 with only a

limited range of software available).

Current Analysis

Robert analyses the Australian market on a weekly basis, and

includes a weekly update of this type of chart.

The small chart at right is a tiny version of the latest

analysis. Toolbox Members can see details and comments in

the latest chart in the Toolbox

Member's Area, or click on the chart at right to view

a large version of the latest analysis. |

|

More information?

For more details see the Share Market Toolbox links at the top of

the column at right.

|

This is one of the many tools in Brainy's Share

Market Toolbox.

The information presented herein represents the

opinions of the web page content owner, and

are not recommendations or endorsements of any product, method,

strategy, etc.

For financial advice, a professional and licensed financial

advisor should be engaged.

Home | DISCLAIMER | Contact

us

© Copyright 2012-2022, R.B.Brain -

Consulting (ABN: 52 791 744 975).

Last revised: 2 May, 2022

|