Why is the notion of a trend important?

One of the key tenets of Dow

Theory basically says:

Once a trend is in place, then it is likely to

remain in place; and

the trend continues to exist until it is confirmed to have

ended.

This is very important, and it is a fundamental principle that

underlines a lot of the success in the market.

Why is it so important or useful? Because if we can identify a

share price rising trend for a stock, and buy some, we can ride

the trend.

It applies to the uptrends, which the average investor /

trader might ride, as well as to the downtrends which

many investors and traders hope to avoid. See more details about

this in the material below.

For more information about Dow Theory, see the More

Information list at right, and also see

more information here about Dow Theory.

Brainy's "3Ways Rule (in 3 Times)"

Any stock or index will

always be trading Any stock or index will

always be trading

in one of 3 "ways":

- in an uptrend, or

- in a downtrend, or

- there will be no trend.

This is a simple re-statement of one tenet of Dow Theory; but it is

a useful way to remember a simple fact about the price chart. That

the chart will show an uptrend,

or a downtrend,

or no trend.

See more information about the 3Ways Rule.

Why avoid a downtrend?

It is important to avoid the downtrends, because they

are likely to continue. When a share price is falling, many people

are tempted to purchase it because it seems to be cheap. And many

commentators and brokers might recommend to buy it because the

share price offers great value. But how do we define great

value? Well, this is very subjective (read more about this topic here).

Because a downtrend is likely to continue, many investors /

traders will not buy the stock until the downtrend is confirmed to

have ended, and a new uptrend has started. Exactly how to do this

depends on a few things, including the time period of the charts

that you study (ie. weekly, daily, hourly, etc.).

How to spot a trend

There are a number of ways to spot an up-trend:

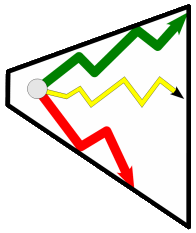

- The simplest eye-ball call

On a price chart, if the price starts in the bottom left

corner and finishes in the top right corner, it must be

trending up (as in the sample at right - click on the image

for a larger version).

Higher Peaks and Higher Troughs Higher Peaks and Higher Troughs

A rising trend is described in classical Dow Theory as a series of Higher Peaks

and Higher Troughs, or as Higher Highs and Higher Lows. This

is demonstrated in the sample chart at right, where each

Higher High is denoted with "HH" and each Higher Low with

"HL". The terms "higher peak" and "higher trough" are also in

common use in reference to a rising trend. However, in the

strict use of the terminology, there is a different between

the "highs and lows" and the "peaks and troughs".

- Trend Line

As a price moves higher, it may be possible to place a rising

straight line under the share price (as in the chart image

above). This line appears to act as a "floor" to support

rising prices. As long as the price stays above the trend

line, then the up-trend is said to be in place. Once the price

breaks below the trend line, then the trend is said to have

failed.

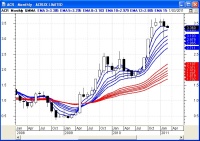

Moving Average Moving Average

We can use a Moving Average chart indicator on the price chart

to indicate whether a price is "trending" up or down (or not

at all). In the sample Monthly price chart at right (click on

the image for a larger version), a Moving Average (MA) is

shown as a blue line. It can be inferred that where the MA is

rising, the stock is also tending to rise (ie. uptrending).

Conversely, a falling MA suggests the stock is trending down.

Of course, the picture might be different on a weekly or daily

chart, and the number of periods we use in the MA indicator

can also make a difference. For a realistic example of using

this idea to spot rising trends, see Brainy's Weekly Watch List strategy.

The health and strength of a trend - MMA

The health and strength of a trend can be quickly

determined using a number of different technical analysis chart

tools, including the Multiple Moving Average (MMA)

indicator on the price chart. There are more than a couple of

these in existence in good charting software packages including

the Guppy MMA (or GMMA for short) and the Hull MMA.

The

sample chart at right is the same chart as shown in the MA example

above, except that this time a Guppy MMA indicator is included. At

first glance, this indicator looks complex; but it is not. It is

comprised of 12 MA lines - a group of 6 blue ones, and a group of

6 red ones. For the trained analyst, this is very helpful in

telling us about the health and nature of a trend (the mood and

sentiment). The

sample chart at right is the same chart as shown in the MA example

above, except that this time a Guppy MMA indicator is included. At

first glance, this indicator looks complex; but it is not. It is

comprised of 12 MA lines - a group of 6 blue ones, and a group of

6 red ones. For the trained analyst, this is very helpful in

telling us about the health and nature of a trend (the mood and

sentiment).

See a sample use of the GMMA in Robert's

Weekly

Market Analysis.

Other tools for determining trend strength include: the simple

trend line, a simple linear regression line, Alan Hull's ROAR

indicator and the ADX indicator.

For more information, see the eBook Articles listed above right.

How to quickly find a trend with little effort

If you are using good charting software, with a good

scan tool, then it is not hard to quickly scan through a long list

of stocks and display a short list of the stocks that currently

exhibit the characteristics of a trend.

One good software tool is BullCharts,

where it is possible to easily create a scan to search for

trending stocks. Brainy's eBook (PDF) Article BC-10-400, "Scans - Match (not) all criteria"

(page 2), discusses this.

And a down-trend...

It is not only up-trends in which we are interested; but

also down-trends. If we feel that a stock in a down-trend is

over-sold and potentially a great bargain, we can monitor the

price chart for a confirmed break of the down-trend. And those

people who are happy to short-sell a stock, can look for confirmed

down trends, and sell into the down-trend.

To visually spot a down-trend on a price chart, we look for the

opposite of the signs of an uptrend - a series of Lower Highs and

Lower Lows (or Lower Peaks and Lower Troughs).

Case Study - NAB

A down

trend is demonstrated in the weekly price chart of National

Australia Bank (NAB) at right from late 2007 until mid-2009 (click

on the chart for a larger image). NAB fell 61% from $43 to $16

over a 16 month period during the so-called infamous GFC (btw -

imagine a blue chip stock falling 61%!). The comments on the chart

at right explain the red down-trend line, and the observed

break-out in March 2009. A down

trend is demonstrated in the weekly price chart of National

Australia Bank (NAB) at right from late 2007 until mid-2009 (click

on the chart for a larger image). NAB fell 61% from $43 to $16

over a 16 month period during the so-called infamous GFC (btw -

imagine a blue chip stock falling 61%!). The comments on the chart

at right explain the red down-trend line, and the observed

break-out in March 2009.

In this chart of NAB we have placed a downward straight line above

the price action, and it appears to act as a ceiling to prevent

prices from rising. Once the price does break above the down-trend

line, it can be said that the trend is over (as indicated toward

the end of this sample chart).

Case Study - MYR

In

the next chart at right, we can see two periods of uptrends

(indicated with the green arrows) over the 8 years or so since the

Myer IPO in 2009. But for the rest of the time, the share price

was in a downtrend. We can easily see a sequence of Lower Peaks

and Lower Troughs across most of this chart. In

the next chart at right, we can see two periods of uptrends

(indicated with the green arrows) over the 8 years or so since the

Myer IPO in 2009. But for the rest of the time, the share price

was in a downtrend. We can easily see a sequence of Lower Peaks

and Lower Troughs across most of this chart.

Trends in multiple time frames

The discussion above is kept simplistic for introductory purposes.

However, it is important to continue the study of trends in

order to consider price trends in multiple time frames. This

differentiates from trends in the short term, from a very likely

different trend in the medium term, and from the longer term.

This next level of study involves the consideration of the highs and

lows on the candlesticks or bars, as well as the existance of peaks

and troughs on different period charts, such as the daily versus

weekly versus monthly charts.

For more information on this, see Trends in multiple time frames (restricted

access to Toolbox Members only).

More information?

For more details about Trends, how to spot them,

and how to use them, see the Share Market Toolbox links at the top

of the column at right.

|

More Information

Case studies - in numerous articles published by The Age

(Fairfax press), and the ASX.

eBook Articles - Share Market Toolbox Members can see

more details in the following eBook Articles:

(Toolbox non-Members can see the "Page 1" of these Articles from the

Master

List page.)

Robert writes information from time to time about the

market and investing. If you are not a Toolbox Member,

you can register to receive useful free information as it is

published.

Privacy ensured,

unsubscribe anytime.

See the

Testimonials - the things that people say about the

Toolbox and more.

|

Terminology

Any special terms that might be used in the text at left, can

probably be found discussed in the Toolbox somewhere. Perhaps

in Brainy's eBook Articles - see the Master Index list for details. Or, search the eBook

Articles.

The

Share

Market - more information about the market and investing and

trading.

The toolbox is an arsenal of weapons to help you tackle the share

market.

See a list of contents on

the Toolbox

Gateway page.

Robert Brain provides various

support to both new and experienced traders and investors.

Who is Robert Brain?

And whatever you do,

beware of the sharks in the ocean!

|