|

Brainy's

Share Market Toolbox |

|

ASX Investor Update

|

|

Dow Theory and the current bull marketThe

March 2017 edition of the ASX Investor

Update

newsletter features an article Every chart tells a story - it pays to understand the stories in the price charts!Included

below is more information, and larger versions of the

charts |

| You

are here: Share Market

Toolbox

> ASX Investor Update

> ASX

Investor Update March 2017 - more information Related links: Summary list of other ASX articles; About the Share Market; Robert's Philosophy; Share Market GEMs; Share-Market-Ready; Funda-Technical Analysis; Sensible Investing; Contrarian Investing Redefined; |

The March 2017 ASX Investor Update newsletterRobert's contribution to the March 2017 ASX Investor Update newsletter included many more words than could be accommodated in the published version of the newsletter. The full article with additional comments and larger versions of the price charts is included here (Toolbox Members click on the images for a larger version).See the published article at the ASX website, and also see the full edition of this ASX newslettter. Bulls versus Bears: What Dow Theory tells usWhere the sharemarket is now and what may bring a change. According to Dow

Theory

there are reputed to be three stages to a bull market, so which

stage

are we currently in? And what might happen next? What is Dow Theory?Firstly,

the

term Dow Theory refers to a body of knowledge which underpins

key

aspects of contemporary technical analysis. It is not a

methodology for

100 percent guaranteed success in the markets; but it is

extremely useful

because the price charts of various financial instruments

summarise the

opinions of the market participants. Tenet #4 — “A trend remains in effect until a clear reversal”

To help set some foundation understanding, let’s skip the first

three

tenets of Dow Theory and talk briefly about share price trends —

uptrends and downtrends. In technical analysis terms a trend is

defined

on the price chart as a sequence of higher peaks and higher

troughs for

a bull market period (an uptrend), and a sequence of lower peaks

and

lower troughs for a bear market period (a downtrend).

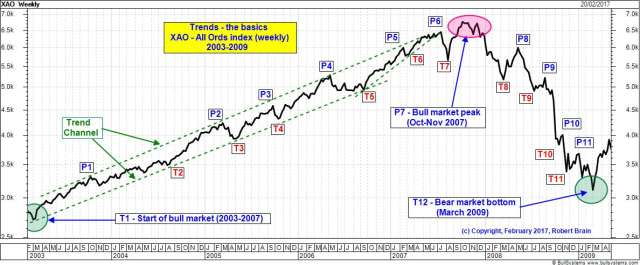

We also note there

are

lots more peaks and troughs on this chart, situated in between

the ones

that are labelled. These indicate the shorter term noise, and in

fact

can also be used to indicate a price trend in shorter time

frames. For

instance, between peak P2 and trough T3 there are several lower

peaks

and lower troughs which indicate a downtrend within this shorter

time

frame. Likewise between P4 and T5 (and also between other peaks

and

troughs). As

it happens, once a trend is in place and confirmed, it is likely

to

continue until it is confirmed to have finished. That means that

if a

downtrend is confirmed for a particular stock, then the

downtrend is

likely to continue, and we should not be entering a position

until the

downtrend is confirmed to have finished. Tenet #2 — “The market has three main movements”This statement is

another of the six tenets of Dow Theory. The first of the three

main

movements to which this refers, is regarding the longer

term bull or

bear markets which can last from one year up to several years.

In the

first price chart above we can clearly see a bull market in the

first

three quarters of the chart which lasted for about five years,

and a

bear market in the last quarter of the chart which lasted for

about 16

months. So a bull market and a bear market are the first of the

three different types of main movements. They can also be

referred to

as a primary movement or primary uptrend (or downtrend). Tenet#3 — “Primary movements have three phases”Now that we have

looked

at our market in recent years, and identified some primary

market

movements (especially the uptrends), we can consider this next

tenet of

Dow Theory. The three phases within the primary movements are

considered to be: (a) accumulation phase, (b) public

participation

phase, and (c) excess phase.

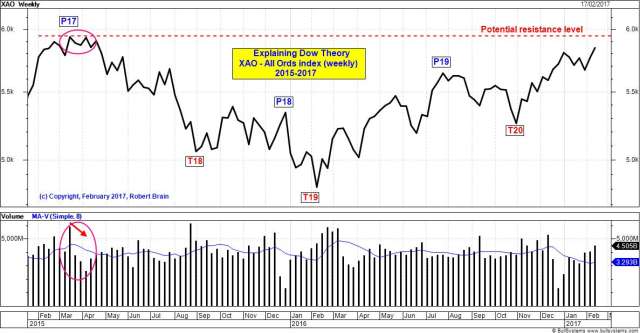

In this chart, note

what

happened the last time a bull market uptrend ended in April 2015

(the

left end of this chart, before falling 19 percent from P17 to

T19). The

index tried to move higher but could not push above about 5960.

For

several consecutive weeks in March and April the volumes

decreased week

on week (indicated in this chart). These declining volumes

indicated

less and less interest in purchasing stocks (ie. declining

demand), and

eventually resulted in the index commencing a fall in late

April. This

is what happens when the demand dries up, leaving a lot more

willing

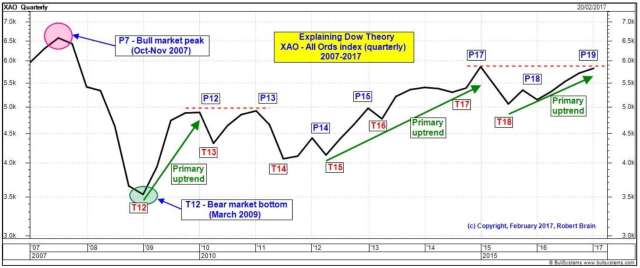

sellers compared to the dwindling numbers of buyers. Also on this topic, note the rising index just after trough T19, and also note the volume bars. The index rallied higher in a clear uptrend to peak P19. The first few volume bars starting at T19 and immediately after T19 are all higher than the preceding volume bars. This indicates support for the higher prices (the higher value of the index - but remember that retail investors don't trade in the index, because they are trading in shares in companies that might make up the index, and it is the volume in these shares which is indicated here). That’s some of the theory, so now let’s look at the practical aspects — and consider the question: Where are we now? Where are we now? — which bull market stage?Let’s start by

looking

at the quarterly chart of the index below (a quarterly chart

shows the

index value at the end of each calendar quarter regardless of

what

happened during the quarter — but a candlestick chart

will show the range in

price). We can easily spot the bear market bottom in March 2009

(T12).

This is followed by what might initially look like a sequence of

higher

peaks and troughs — except that, technically, it is not (because

T14 is

lower than T13, and T18 is lower than T17), even though the

index was

low in March 2009, and is much higher towards the right end of

this

chart. Some people might suggest at a glance that we have an

uptrend on

this chart because the price is low near the left end of the

chart, and

it is higher at the right end.

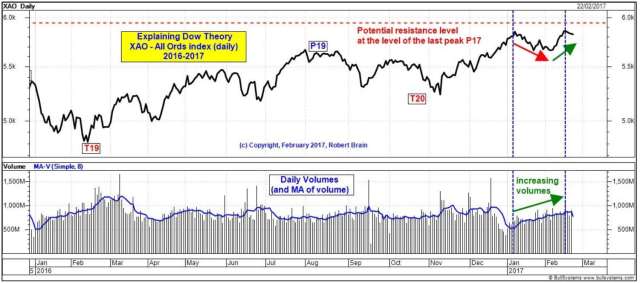

There are actually several periods on this chart that are primary (bull market) uptrends (from T12 to P12, and T15 to P17, and T18 to P19). Each of these have secondary reactions between them. So what is likely to unfold in the coming weeks? If we drill down and look at the weekly or daily chart for the same period, any conclusions should be clearer. So let’s look at the following daily chart.

Firstly, notice at

the right end of the chart that

daily volumes increased through January 2017 and into February

while the

index fell by only 3 percent. This suggests an excess of sellers

(which is bearish).

More Information?Do refer to the online article at ASX.com.au for the published version of this article. Want to understand more about how to interpret the price charts? See the details in the right-hand column above... |

To

print this web page - in your browser select the printing

option "Shrink to fit". View larger versions of the charts below by clicking on the chart. More informationRead more about:

To understand more about how to interpret the underlying mood and sentiment using the price charts:

Share

Market Terminology

See Brainy's eBook Articles, and the Master Index list for details. Or, search the eBook Articles. Robert Brain provides support to both new and experienced traders and investors. Who

is Robert Brain?

The toolbox is an arsenal of weapons to help you tackle the share market. See a list of contents on the Toolbox Gateway page. The Share Market - more information about the market and investing and trading.  And whatever you do,

beware of the sharks in the ocean! |

Also

note one key

aspect of the above discussion. We started by looking at the big

picture — a longer time period on a monthly chart (because

Also

note one key

aspect of the above discussion. We started by looking at the big

picture — a longer time period on a monthly chart (because