What can the candles tell us?

- Example

The candlestick chart can tell us

a lot about the price action in a

"period", as well as the health,

mood and

sentiment of

the market.

The sample candlestick chart at

right is a daily

chart of the XAO

index

(All Ordinaries)

in late October 1997 (a market

correction). Each daily candle

summarises the price action in

each day. (On a weekly chart, each

weekly candle summarises the price

action in a whole week. Likewise

for

monthly, quarterly, yearly, etc.).

Notice the four long black candles

on this sample chart indicating a

savagely falling market index

value, with a long lower tail on

the last candle (indicating a

rejection of lower prices). These

four black

candles represent a daily decrease

in the index by about: 2%, 2%, 3%

and 7% respectively - a total

decline of about 14% in just four

days.

These

candles show that sellers

dominated the market in an almost

panic-stricken manner.

This large fall is followed by a

tall white candle (a rare increase

of

6%), and mostly increasing index

values in the following few days.

The sequence of long black

candles, followed by a tall white

candle is

a candle bottom known as the Tower

Bottom.

One key give-away for

candle-watchers on this chart is

the very long

lower tail on the lowest black

candle, which suggests a

"rejection of

lower prices", and shows that

there were significant buyers in

the

market.

Knowing how to read these simple

candles can be so very useful in

gauging the mood and sentiment of

the market.

|

Sample candlestick chart

XAO

index

(All Ordinaries)

in late October 1997,

a market correction.

(see explanatory text at left)

|

|

What is this example

chart telling us?

In

the example above, the consecutive black

candles, with the last one

having a long lower tail, followed by a

tall white candle, indicates

what we call capitulation

- a concerted effort by desperate

investors to sell their stock at

whatever price just to protect against

further possible downside.

The

long lower tail on the last black candle

indicates that during the day,

even though there was heavy selling

(causing prices to fall further),

enough buyers stepped in to bid prices

higher so that the close for the

day was well above the low for the day.

(Remembering that this chart is

the market index, which is an aggregation

of 500 stocks, it does

reflect that is happening in a number of

the stocks within the index).

The

first white candle on this chart has a

very tiny lower tail, indicating

that buyers were dominating for most of

the session. The height of the

candle also indicates the buyers

dominating. The upper tail on this

candle and the next candle (a Spinning

Top) indicate a weight of

sellers still present; but the next three

white candles indicate the

buyers dominating again.

The index then went on to rise a total of

25 percent from the close on 28 October

over the next 6 months. |

Why is this

useful?

Knowing how to interpret basic candlestick

features and patterns can be

very useful in understanding the mood and

sentiment of the market.

Candles tell us a whole lot more about the

market than the simple line

chart can tell us.

They can help to identify likely turning

points in a stock or in the

market index.

Don't

forget that the price

charts summarise the opinions of

market participants.

|

A quick sample

The humble candlestick chart (like the

sample at right) shows us the

range in price in each "period".

This sample chart is a daily

chart of BHP showing the six candles for

each of six trading days in August. Each

candle shows us the range in

price in each day. The white candle on 20

August has a short lower tail

down to the Low price of the day, and a

very tiny upper tail (or wick)

reaching up to the High of the day.

- On a daily

price chart, the candle summarises the

price action for the day.

- In general terms, the candle

summarises the price action in one

"period".

- The "period" could be a

day on a

daily chart, or a week on a

weekly chart, or a month on a

monthly chart, etc., etc.

In the sample chart at right, the two

candles on 22nd and 25th are

shorter relative to the other

candles on the chart. This shows us a

shorter range in prices from the

high

to the low for each day, when compared to

the other days.

|

Sample Daily chart of BHP

in October 2008

Click on the image for a

larger version in a new window.

(see explanatory text at left)

|

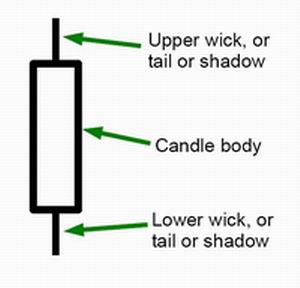

Candlestick basics

On share price charts a

candlestick (or

just simply a candle) can

comprise the following

elements:

- A Body:

- Which can be black or white

(or red or green).

- It can be very tall in size, or

it

can be short.

- In some cases, the candle body is

so short it

appears to have no body at all (eg.

what we call a Doji pattern).

- An upper wick

- also called a tail

or shadow.

- A lower wick

- also called a tail

or shadow.

It is possible to have only one tail on a

candle, or even no tails at

all.

|

|

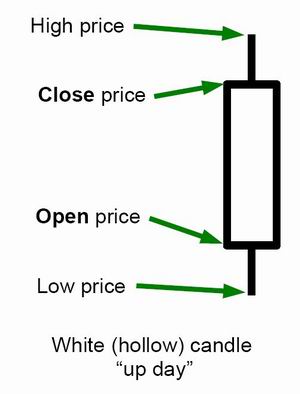

White

candle (or

green)

- The body of the candle is white (or

green).

- The bottom of the body indicates

the Open price for the "period".

- The top of the body indicates the

Close price for the "period".

- The top of the upper wick indicates

the High price for the "period".

- The bottom of the lower wick

indicates the Low price for the

"period".

Note: In case you didn't realise it, there

are four key price values in

every trading period which are captured

and stored, and available to be

viewed in price charts:

- Open price for the period - the

first traded price for the day.

- High price for the period - the

highest price paid during the period.

- Low price for the period - the

lowest price paid during the period.

- Close price for the period - the

last price paid at (or just before)

the close of the period.

|

|

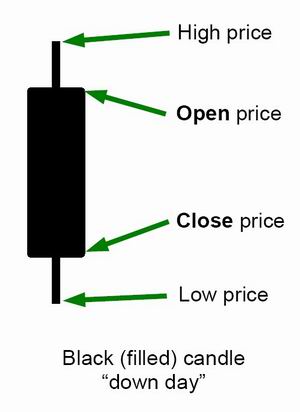

White and black - which is which?

We note the only difference between a

white candle and a black candle

is the position of the open price and

close price.

So, when comparing the white candle

(above) and the black candle

(below), how can we easily remember which

is which? |

How to remember white versus black?

The

colour black is often associated with doom

and gloom, so a black candle

indicates a period where the price fell

during the period, so the close

is lower than the open.

|

Black

candle (or red)

- The body of the candle is black (or

red).

- It is very similar to the white

candle except:

- The top of the body is the Open

price.

- The bottom of the body is the

Close price.

|

|

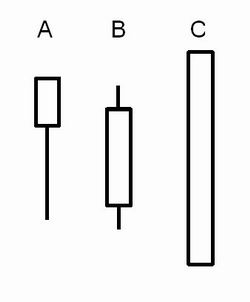

Candle bodies, wicks, tails

When observing individual candles, it is

important to realise that the

candle body, and the tails, are all

optional. The key things to look

for include:

- Is there a body at all? If not, it

will be a Doji.

- Is there an upper wick?

- Is there a lower wick?

- If there is a wick, how long is it?

Note the three samples at right:

- A

long lower tail, suggests a rejection

of lower prices.

- A

fairly normal candle (to see in a

healthy rising trend) with an average

size body, and reasonably sized wicks.

- A

very tall bullish candle with no tails

at all (this specific candle

shape is called a Marubozu).

|

|

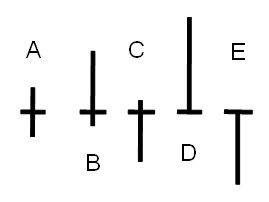

Doji candles

We mentioned Doji candles above. The

diagram at right shows some

variations in the basic Doji candle shape.

These variations are mostly long or short

upper and/or lower tails. |

|

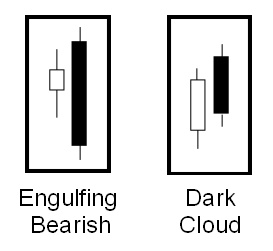

Multi-candle patterns

It is also very useful to observe 2 or 3

adjacent candles, as specific

combinations can give us more good clues

about the mood of the market,

and the presence or absence of buyers and

sellers.

Some candle patterns can also suggest a

likely change in trend.

The two sample candle patterns at right

are what we refer to as

2-candle patterns - there are also

3-candle and 4-candle patterns.

These two patterns are very bearish, and

if seen in a rising trend,

suggest a possible abrupt change in trend

to downward.

|

|

One candle can summarise many

Note the following

regarding the sample price chart of

BHP at right:

- This is actually a 1-minute line

chart with a single candle

superimposed. They apply to intraday

charts

also.

- The 1-minute line chart shows the

price action through the day. There

were 9,958 trades during the day,

so the squiggly line on the chart is

joining up 9,958 points. The price

Opened at $43.57 at 10am, then fell to

a Low of $43.28 around

the middle of the day, then rose to a

High of $43.68 late in

the day, then fell a little in the

last few minutes to Close at $43.65.

- A single blue coloured candle is

superimposed on the chart, summarising

the price action for the day -

so it is a daily candle. This is a

good example of a compound candle.

|

A 1-minute price chart of BHP for the

6-hour

period from 10am to 4pm on 15 January.

Click on the chart for a larger image

in a new window.

|

More information

Also look for more details in Toolbox

Master Index.

Toolbox Members can see more details about

candlesticks...

|

|

More information

There are some free eBook (PDF) Articles on

candles listed here.

Useful

Links

The following web sites have lots of

free information about

candlestick charts and patterns.

History and more at Wikipedia

Bulkowski's Candlestick Patterns

My SMP (Stock Market Power)

Master the Markets - Japanese

Candlesticks

Features

Sensible

Investing - Ask yourself if the advice

you receive

seems sensible.

Funda-Technical

Analysis - A clever blend of

Fundamental Analysis

to identify quality stocks for a watch list, and

Technical Analysis to

time the purchase (and sale) of the stocks to

minimise losses and

maximise profit and capital.

Contrarian Investing Redefined

- The old thinking about contrarian investing now

ought to be

challenged, and somewhat clarified or redefined.

Whatever

you do,

beware of the sharks

in the ocean!

|