Share

price performance after the public float

A collection of

price charts in (reverse) chronological order,

showing some positive and negative stories

regarding high profile IPOs.

Toolbox

Members click on any chart image for a larger

version in a new window.

|

Stock

code,

float/listing date,

and details |

The

first

few weeks or months and

a line chart and/or a candlestick

chart

The candle chart is

useful as it shows the range in price in each period.

Note that these charts might NOT show the latest price

action as they attempt

to show whether investing in the IPO might have

been useful in the medium term. |

Longer

term chart |

DigiCo Infrastructure (DGT)

Float date: Friday 13 December 2024

Offer price: $5.00

First day:

- Open: $4.98

- Low: $4.48

- High: $5.10

- Close: $4.55

Note: A daily candlestick

chart summarises the price action for each day.

|

DGT - The first

one week

(10-minute intraday candle chart)

The first hour of trading

(from 12 noon on Friday 13th December 2024) wasn't bad

for the first couple of hours, but it sold off from 3pm

- see the two Big Black candles among the first five

candles on this chart.

* - A 10-minute candlestick

chart summarises the price action in each 10 minute time

block during the session.

|

DGT - The first

few months

(daily* candle chart)

11 Jan 2025 - This daily

candle chart is showing the first 4 weeks of trading for

this newly listed stock. Note the first two very tall

black (daily) candles, most of which are below the IPO

offer price of $5 (the horizontal dotted red line), show

the early sell-off. Then most of the trading for the

next 4 weeks is within the range of $4.40 to $4.70 -

below the IPO offer price. If you had have participated

in this float and continue to hold the stock, you will

be under water (hence the background colour for this

particular table cell is pink).

|

DGT - After one

year

(weekly* candle chart)

26 Dec 2025 - This weekly

candle chart shows about 12 months worth of price

action. Note that the share price bottomed in April

2025, then rose to less than the IPO price before

commencing a 5-month downtrend to as low as $2.50.

At one point, the share

price was down about 52 per cent from the IPO price. A

clear loser over this period.

|

Guzman y Gomez (GYG)

Float date: 20 June 2024

Offer price:

$22.00

First day:

- Open: $30.00

- Low: $29.29

- High: $30.99

- Close: $30.00

Note: A daily candlestick

chart summarises the price action for each day. Each

candle on a weekly candle chart summarises the price

action for each week.

|

GYG - The first 4

weeks

(daily candle chart)

The first day of trading is

very informative. Trading opened at $30 - that's a whole

$8 above the offer price of $22, or about 36 per cent

higher. Then during the day it traded up and down a

little and closed the day at the open price - forming a

doji candle - indicating general

agreement on the price.

Also notice that some 6

days later there was a 2-day sell-off - likely to be

profit takers.

|

GYG - The first 3

months

(daily candle chart)

This daily candle chart of

the first 3 months of trading shows the early sell-off

in late June (two tall black candles), then a persistent

uptrend to a peak on 11 September

to be up 90 per cent over this period.

|

GYG - The first

18 months

(weekly* candle chart)

After 18 months of trading,

this weekly* chart shows the early uptrend from July

into September 2024, then a flat period until late

November.

A year later, by late 2025,

the share price had fallen to the level of the float

price some 18 months prior. If you had bought in near

the top for more than $40 around December 2024, then by

December 2025 you were down 45 per cent.

|

Nuix Limited (NXL)

Float date: 4 December 2020

Offer price: $5.31

First day:

- Open: $8.50

- Low: $7.27

- High: $9.00

- Close: $8.01

Note: A daily candlestick

chart summarises the price action for each day.

|

NXL - The first

four weeks

(daily* candle chart)

The first day of trading (4

Dec 2020) might be a black candle (indicating the daily

close lower than the open); but with all trading above

$7, this is well above the IPO issue price of $5.31.

For the rest of this chart

over 4 weeks, NXL has traded in a mostly narrow band

between $8 and $9, as though the market participants

agreed is was worth more than $8 but less than $9.

* - A daily candlestick chart

summarises the price action in each day.

|

NXL - The first 3

months

(daily* candle chart)

25 Jan 2021 - So far we

only have 7 weeks of price data here. Note a tall white

candle on this daily chart at 4th January, after which

the daily candles are all mostly taller than prior to

this date, and they start to climb higher. I tend to use

a log price scale ( see a discussion here), otherwise

the tall candles here would look even taller. |

NXL - The first 8

months

(weekly* chart)

The

weekly*

chart above shows the trading over the first eight

months. Remember that on a weekly candle chart, each

candle summarises the price action in one week.

On this chart we can see that

the price stayed above the offer price for at least 2

months, then commenced a downtrend until the share price

dropped below about $3 to be down 72 per cent from the

offer price. (This is one reason that I don't like

IPOs).

* - A weekly

candlestick chart summarises the price action for each week.

|

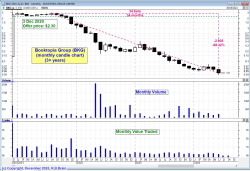

Booktopia (BKG)

Float date: 3 December 2020

Offer price: $2.30

First day:

- Open: $2.86

- Low: $2.58

- High: $2.90

- Close: $2.72

Note: A daily candlestick

chart summarises the price action for each day.

|

BKG - The first

four weeks

(daily* candle chart)

The horizontal dotted line

indicates the IPO offer price (aka float price), and all

trading in the first four weeks is clearly above that

level. So IPO participants were in the money from day

one.

The trading range of the

first three days (from above $2.50 to about $3) covers

most of the trading for the first four weeks shown here.

* - A daily candlestick chart

summarises the price action in each day.

|

BKG - The first 3

months

(daily* candle chart)

22 Jan 2021 - So far we

have just 7 weeks of price data here, and the trend of

the first few weeks has continued with the price stuck

within a range - but notice that the highest values are

progressively lower and lower. From about $3 on day

three, down to below $2.90 a week later, then below

$2.80 on 29th December, then mostly below $2.70 for the

three weeks to 22 January. This indicates that market

participants are less and less confident that the stock

is worth any more than its current price.

|

BKG - 18 months

(monthly* chart)

The

monthly* chart above shows how the share price performed

after topping in August 2021 - it commenced a downtrend

that didn't stop. It fell 98 per cent, and then

de-listed.

* - A monthly

candlestick chart summarises the price action for each month.

|

HiPages (HPG)

Float date: 12 November 2020

Issue price: $2.45

First day:

- Open: $2.84

- Low: $2.46

- High: $2.55

- Close: $2.46

* - A daily candlestick

chart summarises the price action for each day. A

weekly chart summarises the price action for one week, and

shows the high for the week, the low for the week, and the

open and close prices for the week. Read more

about candlestick charts. |

HPG - The first 4

weeks

(daily* candle chart)

Firstly, note that the

trading on day one (12 November) ranged from the open at

$2.84 down to the close at $2.46, and the offer price

was only one cent lower at $2.45. So there was no strong

conviction that the shares were worth much more than the

offer price.

Then for the rest of the

first 4 weeks shown here, the share price has drifted

lower (actually a downtrend), After the second week,

any IPO participant was under water.

* - A daily

candlestick chart summarises the price action for each day.

|

HPG - The first 3

months

(daily* candle chart)

Now with more than 2 months

of price data we can see that the initial downtrend

lasted for 5 weeks until 21 December, with a Big White

candle on 22 December (Christmas holiday week) pushing

the price up to an intraday high exactly equal to the

IPO float price (some people might call that suspicious

as though some of the initial float participants wanted

to force a close out of their position before their

Christmas holiday).

However, from Christmas

onward, the price has resumed its downtrend and float

participants are still underwater. Many astute investors

would look at this downtrend and consider the likelihood

of it continuing, and close out a position to lock in

the loss and protect their capital from any further

downside.

|

HPG - 5 years

(monthly* candle chart)

About a year after listing,

the share price fell below the issue price of $2.45, and

kept going. It bottomed around 65 cents on two occasions

in 2023, then rallied to nearly $1.50 before falling

again. And it fell to more than 60 per cent below the

issue price.

In December 2025 it had

been trading around $1.25, still well below the issue

price.

|

Aussie Broadband (ABB)

Float date: 16 October 2020

Offer price: $1.00

First day:

- Open: $1.73

- Low: $1.68

- High: $1.73

- Close: $1.68

Note: A daily candlestick

chart summarises the price action for each day.

|

ABB - The first 4

weeks

(daily* candle chart)

Firstly, note that the

first day of trading is mostly above $1.75, which was

well above the offer price of $1.00 So IPO participants

were well in the money.

Then for the rest of the

first 4 weeks shown here, the share price has ranged

between a low of $1.70 and a high of $2. It is common

for a share price to turn at a round dollar amount (such

as $2). IPO participants were still well in the money

for these first four weeks.

* - A daily candlestick chart

summarises the price action in each day.

|

ABB - The first 3

months

(weekly* candle chart)

With about 3 months of

price data now, this daily candle chart shows the first

four weeks from the previous chart (at left), plus the

rapid climb higher from about 27 November for a week or

so (around the middle of this chart).

Then through most of

December the price initially fell back to a floor of

just under $2 before trying to rally some more. However

we interpret this, the IPO participants are still well

in the money.

|

ABB - 5 years

later

(monthly* candle chart)

The Aussie Broadband share

price opened on the float day well above the issue price

of $1, and has remained well above that level ever since

(as at December 2025). Mind you, though, in 2022 it fell

back to about $2 before slowly rising over many months.

In September 2025 it had

reached about 495 per cent above the issue price - a

great reward for anyone who bought in early.

* - A monthly candlestick

chart summarises the price action in each month.

|

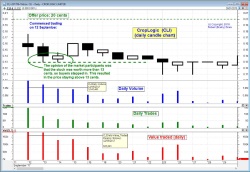

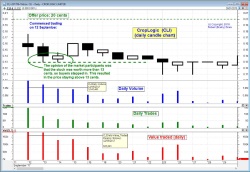

CropLogic Limited (CLI)

www.croplogic.com

Float date: 12 September 2017

Issue price: $0.20

First day:

- Open: $0.16

- Low: $0.14

- High: $0.175

- Close: $0.155

19 November 2019 - Trading halt. No

further trading.

2020 - Entering administration and

company deregistered.

* - A daily candlestick

chart summarises the price action for each day. A

weekly chart summarises the price action for one week, and

shows the high for the week, the low for the week, and the

open and close prices for the week. Read more

about candlestick charts. |

CLI - The first 15 days

Daily* candle chart

This daily* chart shows the

first 14 days of trading and indicates the issue price

at 20 cents near the top of the chart (a horizontal

dashed line), then the first day of trading (the first

candle) is a short-bodied candle with tails, well below

the issue price.

Over the next few days of

trading, the share price stayed roughly within the range

of the first day, and ventured a little lower, but

stayed above 13 cents (at least until 25th September).

That is, the market participants were all believing that

the stock was worth more than 13 cents (a support

level).

The candle on 25th September

has a longer lower tail that penetrates below the 13

cent support level, indicating that some market

participants no longer believed the shares were worth

more than 13 cents.

* - A daily

candlestick chart summarises the price action for each day.

|

CLI - The first 3 months

Daily* candle chart

This daily* chart is similar

to the first one at left (which shows 14 candles), but

covers a period of more than 2 months. You can see the

same first 14 daily candles at the left end of this

chart.

Once the trading broke below

the 13 cent support level, the trading continued for

several days in a range mostly below 13 cents, with one

exception on 2 October.

By mid-October the share

price touched a low of about 10 cents, and then managed

to trade above this level in the following weeks.

For the technical analysts

who understand how to read the Volume bars (and the

Trades and Value) in the lower window panes, there is

more information to be gleaned about the opinions of the

market participants.

|

CLI - The first 4+ months

Weekly* chart

The

weekly*

chart above shows the trading over the first four

months. Remember that on a weekly candle chart, each

candle summarises the price action in one week.

On this chart we can see that

the price stayed above the 10 cent level until the week

of 27 November. Across the rest of this chart the price

tended to trade lower, and stayed below 10 cents from

the week of 11 December.

2019

- Permanent trading halt

click for a larger version

in a new window

* - A weekly

candlestick chart summarises the price action for each week.

|

Afterpay (APT)

Float date: 29

June 2017

Offer price: $1.00

First day:

- Open: $2.70

- Low: $2.65

- High: $2.70

- Close: $2.70

Note: A daily candlestick

chart summarises the price action for each day.

|

APT - The first 4

weeks

(daily* candle chart)

The first day of trading

here shows a clear lack of commitment about the share

price, with the price ranging only between a low of

$2.65 and a high of $2.70. Even so, this is well above

the issue price of $1.00.

After the first 8 days or

so, the price settled into a range between about $3 and

$3.15 - well above the issue price.

* - A daily candlestick chart

summarises the price action in each day.

|

APT - The first 6

months

(weekly* candle chart)

This weekly chart shows 6

months of price action, and that for the first weeks

until mid-August the share price was fairly stable, but

then from mid-August it took off in a good uptrend

across this chart, rising to above $7 by mid-January

2018. That's a very nice profit for the early investors.

Mind you, this sort of

share price performance is not common with regular IPOs.

|

APT - The first 3

years

(weekly* candle chart)

Now with more than 3 years

of price history we can see that the share price has

looked back only once during the coronavirus pandemic of

March 2020.

Except for that

interruption, this chart clearly shows a steady uptrend

taking the share price from the original offer price of

$1 to above $100 in late 2020. That is a very nice

profit for the believers who stayed onboard, and for

those investors and traders who joined the trend.

|

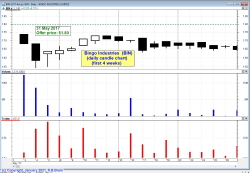

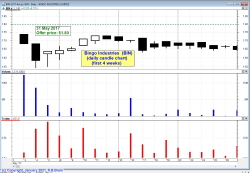

Bingo Industries (BIN)

Float date: 3 May 2017

Offer

price: $1.80

First day:

- Open: $1.73

- Low: $1.68

- High: $1.73

- Close: $1.68

Note: A daiy candlestick

chart summarises the price action for each day.

|

BIN - The first

four weeks

daily* candle chart)

Bingo Industries floated on

3 May 2017 at an offer price of $1.80. On the first day

it traded below this level, and fell further on the

second day. Then for the rest of its first 4 weeks it

continued to trade around this level - between about

$1.65 and $1.73. That's below its issue price with IPO

participants under water.

* - A daily candlestick chart

summarises the price action in each day.

|

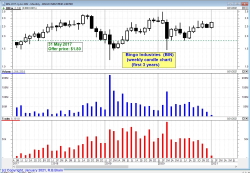

BIN - The first

12 months

(weekly* candle chart)

This chart is a weekly*

over a 12 month period and shows that after the for few

weeks under water, the share price pushed above its

issue price in August 2017, and continued to trend

higher to above $2.50, putting the IPO participants into

a nice profit. In fact, the trend ruler on the chart

shows a 68 percent rise over 52 weeks (a very nice

profit).

|

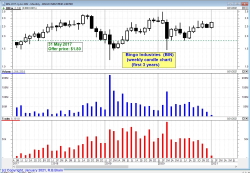

BIN- The first 3

years

(monthly* chart)

This is a monthly* chart

over the first 3 years. It shows that after hitting

above $3 in mid-2018, the share price fell back to the

issue price before rallying in late 2019, and falling

again in 2020.

Is there a lesson to learn

from this share price performance? One lesson is that a

price increase is not guaranteed, and that sometimes it

can pay to lock in profits and protect capital.

* - A monthly candlestick

chart summarises the price action each month.

|

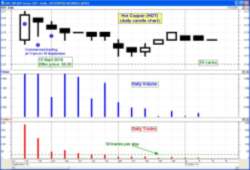

Hot Copper (HOT)

http://investors.hotcopper.com.au

15 September 2016 (11am)

Offer

price: $0.20

First day:

- Open: $0.23

- Low: $0.225

- High: $0.27

- Close: $0.265

Note: An hourly candlestick

chart summarises the price action for each hour.

|

HOT - The first two days

only

(hourly* candle chart)

On day 1, in the first hour

of trade (from 11am), the share price opened at 23c,

above the issue price of 20c. For the rest of the day,

in each hour, the price moved higher to close the day at

26.5cents.

Day 2 - High volume with a

black candle as sellers took profits. Price stayed

mostly above 24c during this day. Volumes mostly lower

each hour, and the number of trades each hour below 20

(ie. max of one every three minutes, suggests not a lot

of interest).

Day 3 - No trade in the first

hour.

* - An hourly candlestick

chart summarises the price action in each hourly period.

|

HOT - The first few weeks

(daily* candle chart)

From day 2 onwards for 6

days, the trading was within the range of the first day,

and progressively lower.

Trading on Monday 26 Sept

fell below the previous trading range but stayed above a

floor (a support

level) of 21cents.

The overall price trend on

this chart is down, with a Lower Peak on 30 Sept (the

high of the daily candle), and a Lower Trough on 26, 27,

and 28 Sept (the lows of the three candles). Read more about price trends.

|

HOT - The first 6+ months

(weekly* chart)

On this chart we can now see

a confirmed downtrend, with a sequence of lower peaks

and lower troughs.

For about 5 weeks through

December 2016 and into January 2017 the share price

hovered around the IPO float price level of 20 cents,

before continuing its movement lower.

Note the number of weekly

trades in the bottom pane is less than 30 trades per

week from mid-November onwards. Many traders look for

more than 50 trades

per day on average.

|

Wellard Limited (WLD)

www.wellard.com.au

10 December 2015 (12pm)

Offer price: $1.39

First day:

- Open: $1.39

- Low: $1.31

- High: $1.39

- Close: $1.39

This case study sample is a classic example of how there

were several warnings about potentially lower prices

ahead, and investors could have cut losses, and protected

capital, by closing a position. Make sure to read the

comments at right about each of these three price

charts.

As at early October 2016, WLD shares are more than 80

percent below their issue price. So $10,000 invested at

IPO time was now worth only $2,000 - that's a

reduction of $8,000. It doesn't seem to make sense to hold

on for this long in the hope of a turn around - that mind

set is for the big guns with lots of money (the fund

managers who manage other people's money).

See latest price chart at ASX.com.au.

June 2016, news in

The Age:-

Cattle exporter joins list of worst IPOs

this year

* - A daily candlestick

chart summarises the price action for each day. A

weekly chart summarises the price action for one week, and

shows the high for the week, the low for the week, and the

open and close prices for the week. Read more

about candlestick charts. |

WLD - The first 18 days

(daily* candle chart)

The first candlestick is very

telling - it closed at the open price for the day

($1.39), but traded as low as $1.31 on rather high

volume (compared to the following days). This candle is

a Dragonfly candle, and shows the presence of sellers

during the day who were over-powered by the weight of

buyers.

However, over the next 5

trading days the share price made lower highs each day.

Then for the next 11 trading days the share price was

stuck in a narrow range between $1.39 (the float price)

and a low of about $1.35 (a support

level). Investors were not sure whether to support

higher prices by buying more, or to sell.

The answer came on 6th

January with trading below the $1.35 support level, on

volume that was higher than most prior days.

We also notice on this chart

that the daily volume

and daily trades

values were high enough to make this a liquid stock and

able to be traded on the basis that a sell order would

probably be filled quickly. (Read more at

Stock Liquidity.)

* - A daily candlestick chart

summarises the price action for each day.

|

WLD - The first three

months

(daily* candle chart)

After

falling below the initial support level of $1.35 on 6th

January, then next few candles are mostly Big Black

ones, with a very bearish Big Black candle on very high

volume on 11 January. The price settled at the

close on 12 January at $1.10 - this was the lowest level

for the price for some time to come.

The share price then rallied

through January to just under the float price, and again

traded in a narrow range for 9 days, with a new support

level at about $1.32. Then on 8th February it again fell

below this support to sit above $1.13 - a new support

level.

|

WLD - The first 10 months

(weekly* chart)

The

price

action described at left in the two daily charts is

covered on the above weekly chart in just the first 11

candles. After that, the share price continued the fall

that it started on 8th February, and paused the fall

above 67 cents in early April. A red dotted line is

drawn on the chart above the price action to indicate

the confirmed downtrend

(a sequence of lower peaks).

The astute technical analyst

probably exited the position during this downtrend,

because of the belief that a confirmed downtrend is

likely to continue until it is confirmed to be over

(refer one of the six tenets of Dow Theory).

For any investors who held on

further, another sell-off took place over three weeks in

May/June, and then another in August. There were plenty

of opportunities to cut losses and close a position.

|

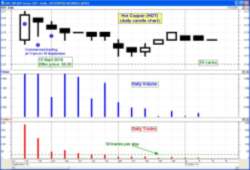

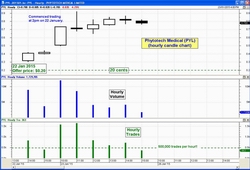

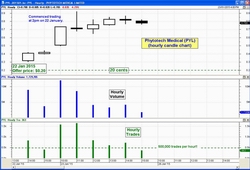

Phytotech Medical Limited (PYL)

Since July 2015:

Known as MMJ Phytotech

Limited.

www.mmjphytotech.com.au

22 January 2015 (2pm)

Offer

price: $0.20

First day:

- Open: $0.32

- Low: $0.305

- High: $0.42

- Close: $0.41

Note: An hourly candlestick

chart summarises the price action for each hour.

July 2015:

Phytotech Medical merged into MMJ to become MMJ Phytotech

Limited.

|

PYL - The first two days

only

(hourly* candle chart)

An hourly chart showing just

the first two days of trading - a winner from day one

* - An hourly candlestick

chart summarises the price action in each hourly period.

|

PYL - The first few weeks

(daily* candle chart)

27

February 2015 update - This daily price chart

(also showing volume in the middle pane and Trades in

the lower pane) clearly shows the strong price run in

the first 2 days of trading (up to about 80 cents),

followed by the slump back below 30 cents by 9th

February. For the rest of February, the price has traded

within the range of about 31 to 43 cents. Still well up

on the issue price.

|

PYL - The first few

months

(daily chart)

10

June 2015 update - This latest price chart

continues to show the small trading range, but at lower

levels than back in February. Except for one price spike

to 34 cents on 28 June, the price has traded within the

range of 26.5 to 33 cents tops. This is still above the

issue price, but any investor who has been holding on

has missed out on other investment opportunities. Also

note that the high daily volumes (and trades) of the

first few weeks have now dissipated, and in fact the

number of daily trades has fallen below the 50 per day

level.

|

oOh!media Limited (OML)

www.oohmedia.com.au

17 December 2014 (12pm)

Offer

price: $1.93

First day:

- Open: $1.89

- Low: $1.80

- High: $1.90

- Close: $1.90

Note: A daily candlestick

chart summarises the price action for each day.

See latest price chart at ASX.com.au.

Updated: 10 June 2015

Update 4 October 2016:-

Now this stock has been a winner. The last chart at right

shows the share price up to a peak of around $2.70. Since

then, the price continued to rally to a peak about $5.50

in August 2016. That's an increase of about 180 percent

(or 88 percent per annum annualised).

|

OML - The first few days

only

(hourly* candle chart)

An hourly chart showing just

the first 6 days of trading - below, then above,

and below, the issue price.

* - An hourly candlestick

chart summarises the price action in each hourly period.

|

OML - The first 4 weeks

(daily* candle chart)

9

January update - The share price has traded in

a rather small range up to 5 percent above the issue

price. We have now included in the Daily Trades in the

lowest pane of the chart, and showing that it has been

trading at less than 50 times per day on most days

(which for some traders makes it illiquid - see more details about stock liquidity).

* - A daily candle chart

summarises the price action each day.

|

OML - The first few

months

(daily chart)

June

2015 update - The share price initially went no

where for a few weeks, and then shot up about 30 percent

in the next month. Since early March it has mostly

traded sideways until the short term run in early May,

and has recently fallen away from that high.

Nonetheless, it has been up, and is still up, about 30

percent from the issue price.

|

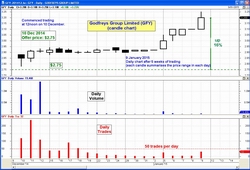

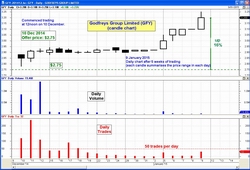

Godfreys Group Limited (GFY)

www.godfreys.com.au

10 December 2014 (12pm)

Offer

price: $2.75

First day:

- Open: $2.88

- Low: $2.78

- High: $2.88

- Close: $2.85

Note: A daily candlestick

chart summarises the price action for each day.

See latest price chart at ASX.com.au.

Updated: 10 June

2015

| Update 4 October 2016:

The last share price shown in the right hand chart

was in June 2015, and the stock was up on the

issue price. However, by October 2015 the price

fell heavily below a support level of about $2.90

(chart not shown here). By February 2016 the share

price was down into a trading range of between

$1.00 and $1.20. Then by September 2016 it was

down under 85cents. This is another stock were it

was initially a winner, but turned into a capital

killer, and in hindsight should have been sold off

to protect capital. |

|

GFY - The first few days

only

(30 minute* candle chart)

Trading well above the float

price from day one.

* - A 30 minute candle chart

summarises the price action in each 30 minute period.

|

GFY - The first 5 weeks

(daily* candle chart)

9

January update - The share price continued to

trade in a very small range until early January when it

took off to end up 16 percent higher on 9 January. We

have now included in the Daily Trades in the lowest pane

of the chart, and showing that it has been trading at

less than 50 times per day (which for some traders makes

it illiquid - see more

details about stock liquidity).

* - A daily candle chart

summarises the price action each day.

|

GFY - The first few

months

(daily candle chart)

June

2015 update - An investor in this IPO could

have sold their stock in early March for at least a 20

percent gain. Anyone who has held on until the latest

date on this chart (9 June) would have seen the value

stagnate for the last 3 months. Also, we can see in the

bottom pane of the price chart "Trades" that the number

of trades each day is below the 50 level, so that it's

viability as a liquid and tradeable stock would have to

be questioned.

|

Estia Health Limited (EHE)

www.estiahealth.com.au

5 December 2014 (12pm)

Offer

price: $5.75

First day:

- Open: $4.98

- Low: $4.71

- High: $4.99

- Close: $4.74

Note: A daily candlestick

chart summarises the price action for each day.

See latest price chart at ASX.com.au.

Updated: 5

June 2015

NOTE (October 2016):

The share price peaked in November 2015 (not shown in the

charts here) at about $7.80, then commenced a clear

downtrend to a pause in June to August 2016, then it fell

off a cliff in August 2016. At last glance it was trading

between $3.00 and $3.50, which is well below the issue

price. The lesson here is that if a downtrend is

confirmed, then consider liquidating to lock in profits

and protect the capital from further possible downside.

There is no point holding on forever. See the latest price

chart far right.

|

EHE - The first few days

only

(30 minute* candle chart)

Trading well below the float

price from day one, and after one week is about 18

percent below.

* - A 30 minute candle chart

summarises the price action in each 30 minute period.

|

EHE - The first 3 weeks

(daily* candle chart)

9

January update - The share price has continued

to trade in a consistent range about 5 percent below the

issue price. We are also showing the number of trades

each day, with recent values between about 100 and 500,

which makes this a liquid stock (for some traders - see

more details

about stock liquidity).

* - A daily candle chart

summarises the price action each day.

|

EHE - The first few

months

(daily chart)

June

2015 update - This stock has trended higher

fairly consistently since the lows of December-January.

It finally pushed above the issue price in February, and

retreated back to sit on that price in April. Overall -

it has not been very profitable yet.

|

Bapcor (BAP)

www.bapcor.com.au

(formerly known as Burson Group, renamed in 2016)

24 April 2014 (12 noon)

Issue

price: $1.82

First

day: Close $2.05

*Note: A candle on a daily candlestick

chart summarises the price action for each day, and

each candle on a weekly candle chart summarises the price

action for one week.

See latest price chart at ASX.com.au.

|

BAP - The first3 months

(daily candle* chart)

Observations:

Up for a few days, then down to about the issue price

before consolidating at that level for about 10 days

while investors contemplated protecting their capital by

selling. Once all sellers at that level were

satisfied, the price rallied to above the issue price

and consolidated again (more contemplation by

investors).

|

BAP - The first 12 months

(weekly candle chart)

Observations:

After about 4 months the price plateaued and

consolidated for about 24 weeks before rallying further.

Investors appear to have been contemplating whether a

higher price could be justified.

|

BAP - Almost 3 years

(weekly chart)

Observations:

More than two years since listing, the price

peaked at about $6.50 (about 240 percent increase); but

fell away in Sept-Oct 2016 and consolidated again (under

$6). Even so, still a nice profit.

|

Medibank Private Limited (MPL)

www.medibank.com.au

25 November 2014 (12pm)

Initial indicative range:

$1.55 to $2

Offer price for retail investors: $2.00

Offer price for

institutions: $2.15

First day:

- Open: $2.22

- Low: $2.14

- High: $2.23

- Close: $2.14

This float would have to be the biggest, most talked about

float in 2014. The public offering was well

over-subscribed, with the allocation to retail investors

scaled back.

Note: A daily candlestick

chart summarises the price action for each day.

See latest price chart at ASX.com.au.

Updated: 5

June 2015

Update 4 October 2016: The share price finally

broke above the $2.50 level in March 2016 (not shown on a

chart here) to trend higher to a peak above $3.20 in

May-June 2016. However, the share price gapped lower in

August 2016 and down-trended to under $2.50 in late

September 2016.

|

MPL - The first few days

only

(10 minute* candle chart)

Trading above the retail

float price, but hovering around the institutional price

(hence some fund managers are not happy).

Trading in the first 3 days

(at about $2.20) was above the institutional float

price; but with black candles indicating a tendency to

move lower.

* - A 10 minute candle chart

summarises the price action in each 10 minute period.

|

MPL - The first 7 weeks

(daily* candle chart)

9

January 2015 update - Since the last update

below, the share price has moved higher to be about 20

percent above the (retail) offer price, and is also well

in the money for the institutional investors.

26

December update - For the first two weeks of

trading, the share price hovered around the $2.15 level

- the institution's offer price. Then in the last hour

of trading on 8th December, a larger number of shares

traded hands, pushing the price above the recent trading

range. After another week, the price has rallied

strongly on the Christmas Eve trading half day (trading

ends at 2pm on Christmas Eve).

* - A daily candle chart

summarises the price action in each hour.

|

MPL - The first 6 months

(daily chart)

June

2015 update - MPL formed a Double Top pattern

in February, and started trending down, and is now below

the institutional issue price, and not much above the

retail offer price.

|

Nine Entertainment Co (NEC)

www.nineentertainment.com.au

6 December 2013

Offer price: $2.05

First day:

- Open: $2.02

- Low: $1.975

- High: $2.07

- Close: $2.98

Note: A daily candlestick

chart shows the range in price during each day.

NEC traded below the issue price for several weeks, then

moved higher (with an indication of buyer support

reflected in the breakout candle).

See latest price chart at ASX.com.au.

Updated: 31 July 2014

Update 4 October 2016:

The downtrend shown on the last chart at right from a peak

in April 2014 continued into January 2015 to see a low of

about $1.65. After a recovery, the share price ended up

falling to lows of under $1.00 in August 2016. This

is another example of how any investors who "believed in

the company" and held on for the longer term have seen

their capital diminish.

|

NEC - The first 6 weeks

(daily line chart)

NEC traded below the issue price

for several weeks, then moved

above the issue price. |

NEC - The first 3 months

(daily candle chart)

NEC turned up above the offer price

after several weeks.

(Toolbox Members click on the chart

for a larger version) |

NEC - The first 8 months

(daily chart)

After 8 months of trading, the share price fell away from

March-April highs

back to the issue price.

|

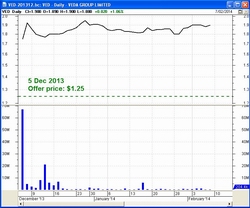

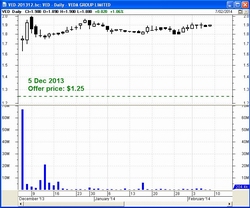

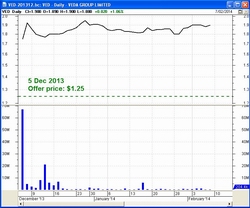

Veda Group Limited (VED)

www.veda.com.au

5 December 2013

Offer price: $1.25

First day:

- Open: $1.74

- Low: $1.63

- High: $1.78

- Close: $1.75

Note: A daily candlestick

chart shows the range in price during each day.

See latest price chart at ASX.com.au.

Update March 2016:

Referring to Chart VED#4

at right, we can see from the end of the chart VED#3 the

share price rallied back up towards the $2.50 peak it had

already reached back in March 2014, then traded sideways

between $2.15 and $2.50 until August 2015. At that point

the price fell sharply to hit $2.00 in mid-September 2015,

then spiked to above $2.60 (on 18 Sept 2015). It then

rallied slowly higher to $2.82 where it entered a trading

halt on 11 February 2016 due to a takeover by Equifax Inc.

|

VED - The first few weeks

(daily line chart)

Veda has traded well above the

issue price for at least the first

few weeks. |

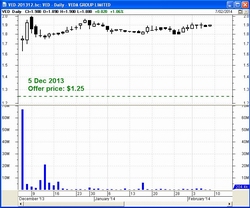

VED - The first few weeks

(daily candles)

|

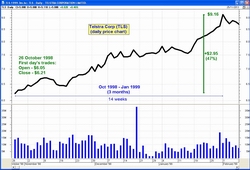

Chart VED#3

VED - The first 8 months

(daily candles)

Even after

a downtrend from March to July, stock is still 47 percent

above issue price.

Chart VED#4

VED - All price action

(Weekly candles)

(Dec 2013-Feb 2016)

|

Dick Smith (DSH)

Company now delisted

see details at www.delisted.com.au

Floated: 4 December 2013

Offer price: $2.20

First day:

- Open: $2.28

- Low: $2.16

- High: $2.32

- Close: $2.20

Note: A daily candlestick

chart shows the range in price during each day.

NOTES:

With reference to the Chart

DSH#4 at right, we note that after the share

price had traded above a support level of about $1.92

for many months, the Big Black candle on high volume in

August 2015 was the start of a final downtrend.

The Downtrend line sitting above the share price on the

chart appears to act as a ceiling above the price. By

the time the company was delisted in December 2015, the

share price had fallen 83 percent below its issue price

two years earlier.

As often happens with falling share prices, this price

chart provided ample opportunity for investors to see

the writing on the wall, and to reduce or close a

position and protect their investment capital from

further downside.

|

DSH - The first 2 months

(daily candle chart)

NOTES:

The Dick Smith (DSH) share

price moved either side of it's issue price in

the first few weeks.

Daily volume rather high on

the first day (normal for a float), but subsequently

fell away.

|

DSH - The first 8 months

(daily candles)

NOTES:

This daily candle chart shows

a confirmed down trend "channel" from the highs of

January 2014. (The two channel lines are not parallel so

perhaps this should really be called a falling flag

pattern).

A Big Black candle on 19 February

with much higher volume indicates an abundance of

sellers wanting to exit their positions. In the

following weeks the price rallied because enough buyers

thought the price was a good value proposition (later

proved to be wrong).

|

Chart DSH#3

DSH - The first 19 months

(weekly candles)

NOTES:

Basically, the share price in

this period (December 2013 to July 2015) moved within a

range above about $1.92. The highs of the highest

candles were successively lower, suggesting that

investors were not convinced the shares were worth any

more than the issue price of $2.20.

Chart DSH#4

DSH - The entire 2 years

(weekly candles)

|

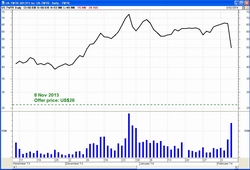

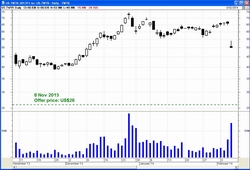

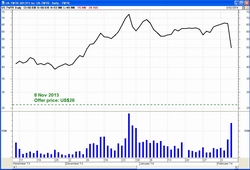

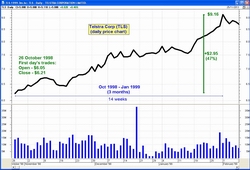

Twitter (TWTR)

https://about.twitter.com/investor

8 November 2013

Offer price: US$26

The two charts at right look a little odd, with all the

price action at the top of the chart. This is because the

stock was offered at US$26, but then traded well above

this price from day one. This means that those who bought

into the IPO were significantly in the money (in the first

few weeks.

See latest price chart at Yahoo.

Updated: 31 July 2014 |

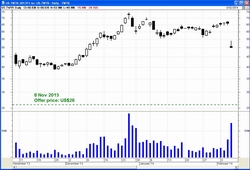

TWTR - The first 3 months

(daily line chart)

Twitter opened above the issue price and traded strongly

higher for a few weeks, then moved sideways until early

February. |

TWTR - The first 3 months

(daily candles)

See the updated chart and analysis at right before you

draw a conclusion about the value of investing in IPOs. |

TWTR - The first 9 months

(daily line)

Twitter rallied strongly in the first weeks, then fell 58

percent almost back down to the issue price. It has

rallied again since early June. Even though investors are

now in profit, this is a good example of being prepared to

protect profits by selling once a downtrend has started.

|

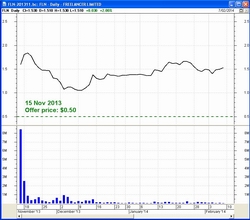

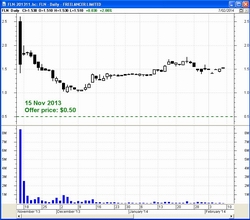

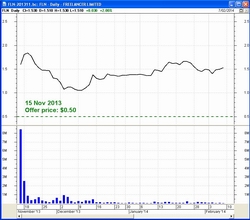

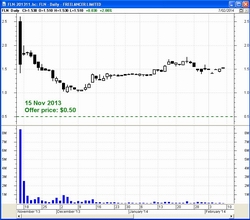

Freelancer Limited (FLN)

www.freelancer.com

15 November 2013

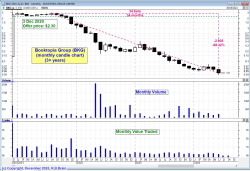

Offer price: 50c,

with first days trading well above.

First day:

- Open $2.50

- Low: $1.42

- High: $2.60

- Close: $1.60

Note: A daily candlestick

chart shows the range in price during each day.

See latest price chart at ASX.com.au.

Updated: 31 July 2014

|

FLN - The first few weeks

(daily line chart)

Trading above the issue price,

then mostly sideways for

the first few weeks. |

FLN - The first few weeks

(daily candles)

This candlestick chart clearly shows the range in price,

with a very tall candle (large range) on day one. |

FLN - The first 8 months

(daily line chart)

This chart shows the sharp rally on day one,

followed by a fall in the following days, then a tend

higher to almost the November highs followed by a

consistent downtrend from March 2014.

|

Sealink Travel Group (SLK)

www.sealink.com.au

16 October 2013

Offer price: $1.10

See latest price chart at ASX.com.au.

See the charts at right for details (Toolbox Members click

on the chart for a larger version).

NOTE: A note about

liquidity (noting the number of trades each day/week in

the charts at right):

If an investor/trader is keen to "protect capital", and

intends to sell a stock once price weakness is confirmed,

then it it important to have some buyers in the market who

are ready to buy the stock. If a stock trades less than 50

times per day (for example), this equates to an average of

one trade about every 7 minutes. When price weakness

becomes obvious to everyone, the chances of having a buyer

in the market are greatly reduced. So, rather than

liquidating your stock with minimal loss, you might be

stuck with a stock with a rapidly declining share price.

Updated: 31 July

2014

|

SLK - The first few weeks

(daily line chart) |

SLK - The first five

months

(daily candles + volume + trades)

This candlestick chart is over a 5 month period,

and some candles are simple doji candles suggesting that

trading is light on some days (ie. an illiquid stock).

The

bottom window pane in the price chart is the number of

trades each day. |

SLK - The first nine

months

(weekly candles + volume + trades)

The share price has been sitting above a support level for

weeks (at least from February to July 2014).

The weekly trades chart above continues to show this stock

is not liquid enough for many investors/traders.

|

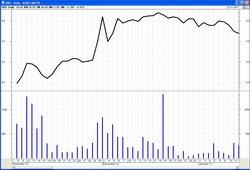

OzForex (OFX)

2017 - The company

re-branded from OzForex to OFX Group Limited https://www.ofx.com/en-au/

11 October 2013

Offer price: $2

See latest price chart at ASX.com.au.

Consistently trading well above the offer price, in a

nicely rising up trend, at least for the first

five months until March 2014.

Updated: 31 July 2014

|

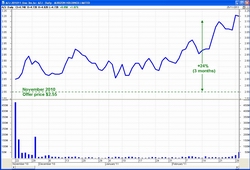

OFX - The first five

months

(daily line chart)

This daily line chart for the first 5 months clearly shows

the uptrend under way, taking the share price even higher

than the early trading prices (and above the issue price). |

OFX - The first five

months

(daily candles) |

OFX - The first ten

months

(weekly candles)

Since the highs of March 2014, the stock has traded lower

in a consistent downtrend, except for the 2-week

retracement in May 2014, followed by a Big Black candle on heavy volume.

|

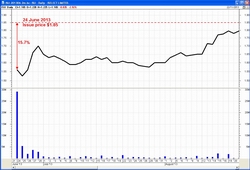

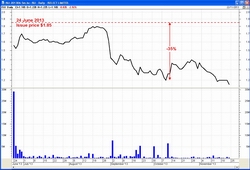

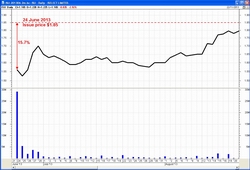

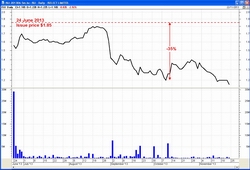

iSelect (ISU)

www.iselect.com.au

24 June 2013

Offer price: $1.85

First day - down 15.7 percent.

First two months - trending higher from day one but still

underwater.

After 5 months - strong down trend - loser.

|

ISU - The first two

months

(daily line chart) |

ISU - The first two

months

(daily candles) |

ISU - First 5 months

(weekly chart) |

Xero Limited (XRO)

www.xero.com/au/

Commenced trading on ASX:

8 November 2012

First day's close: $4.48

Has been listed on the NZX since June 2007.

|

XRO - The first two

months

(daily line chart) |

XRO - The first two

months

(daily candles) |

XRO - First 12 months

(weekly chart) |

Virtus Health (VRT)

June 2013

|

|

|

|

360 Cap ind fund (TIX)

December 2012

|

|

|

|

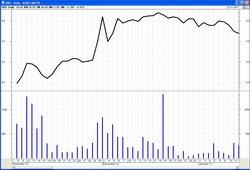

QR

National

(QRN)

December 2012 rebranded to: Aurizon (AZJ)

www.aurizon.com.au

22 November 2010

Offer price: $2.55

Touted at the time as Australia's biggest float in more

than a decade (BusinessDay).

More detail: Wikipedia.

|

AZJ (QRN) - The first

three months

(daily line chart) |

AZJ (QRN) - The first

three months

(daily candles) |

AZJ - First 3 years

(weekly chart) |

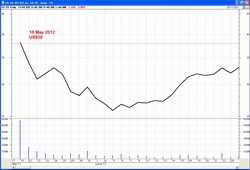

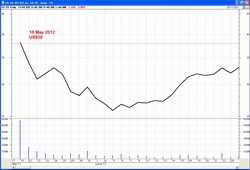

Facebook

(FB)

18 May 2012

www.facebook.com

Offer price: US$38

This float was highly anticipated, and many people felt

like they needed to participate. This stock was under

water for 14 months. Capital invested elsewhere could have

made some good returns.

|

Facebook - The first five

weeks

(daily line chart) |

Facebook - The first four

months

(daily candles) |

Facebook - 19 months

(daily chart) |

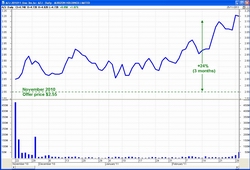

NextDC

(NXT)

13 Dec 2010

www.nextdc.com

Offer price: $1.00

|

NextDC - The first 3

months

(daily line chart)

Traded consistently above the offer price. |

NextDC -

The first 3

months

(daily candles) |

NextDC -

3 years

(weekly chart)

Traded consistently above the offer price. |

Myer (MYR)

www.myer.com.au

2 November 2009

Offer price: $4.10

First day: Open: $3.88, Close: $3.75

|

MYR - The first three

months

(daily line chart) |

MYR - The first three

months

(daily candles) |

MYR - First 4 years

(weekly chart) |

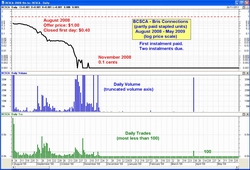

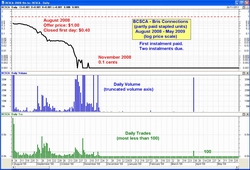

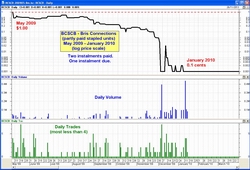

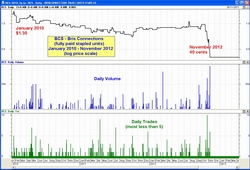

BrisConnections (BCS)

www.brisconnections.com.au

July 2008 - For listing details, see the notes under each

chart at right.

Notes for the charts:

(a) Logarithmic price scale makes it

easier to see the price action details

at lower prices.

(b) Volume is low (or zero) on many days.

(c) Number of trades per day is very low

(or zero) on many days.

Items (b) and (c) indicate low liquidity,

and difficult to exit if desired.

Also see opinion comment, and more information

at Wikipedia.org.

|

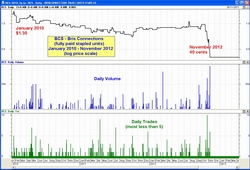

BCSCA - August 2008 - May

2009

(daily line chart)

Listed:- 31 July 2008

(code:BCSCA)

Initial instalment: $1

with two further $1 instalments owing.

First day - fell 60 percent.

November 2008 - shares had fallen

to 0.1cents. Trading continued

occasionally at very low volumes.

|

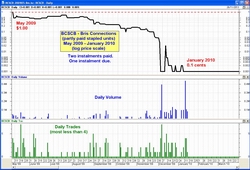

BCSCB - May 2009 -

January 2010

(daily line chart)

May 2009

(code:BCSCB)

Second instalment paid ($1),

taking the paid-up cost to $2 per share,

with trading on 7 May 2009 to a

daily low of 51cents and closing at $1.

13 Jan 2010 -

Trading suspended pending

payment of the third and final $1

instalment, taking the fully paid-up

cost to $3.

|

BCS - January 2010 -

November 2012

(daily line chart)

Friday 15 January 2010

(code:BCS)

Trading in fully paid securities started,

with one trade for the day at $1.30.

13 Nov 2012 - Shares

suspended

from trading.

|

Asciano (AIO)

www.asciano.com.au

6 June 2007 - Demerged from Toll Holdings.

Stock debut: $10.35

Note: Subsequent share issues, raising, dilutions, etc.,

result in the historic share price being corrected,

to show historic prices that don't appear to relate to the

original raisings.

|

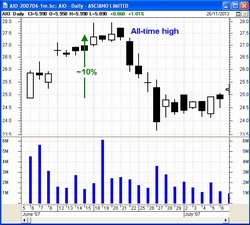

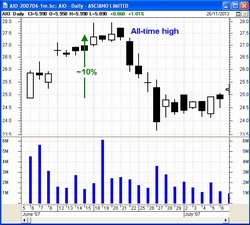

AIO - The first five

weeks

(daily candle chart)

Note: Nice 10 percent increase in the

first two weeks to an all-time high,

and then just down from there. |

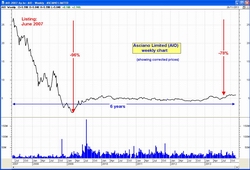

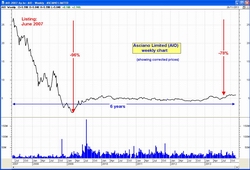

AIO - The first 20 months

(weekly line chart)

Note: From the all-time high just after

listing, it was all down hill for 20 months

to an all-time low. A fall of 96 percent. |

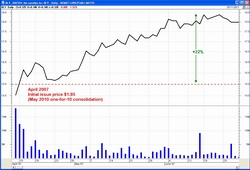

AIO - The first 6 years

(weekly line chart)

Note: Since the all-time low in February-

March 2009, the share price first

rose for a while, and then has traded

mostly sideways ever since.

|

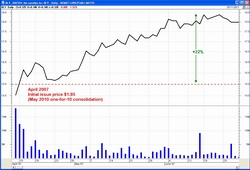

Boart Longyear (BLY)

www.boartlongyear.com

5 April 2007

Offer price: $1.85

(Said to be the second largest IPO in the history of the

ASX - Source: Wikipedia).

May 2010 - Share consolidation (one for 10), increased the

nominal share price, and back-adjusted the IPO price up to

$15.

|

BLY - The first three

months

(daily line chart) |

BLY - The first three

months

(daily candles) |

BLY - The first 6 years

(weekly chart)

Note: This chart should be drawn with

a logarithmic price scale for a

better depiction of price action. |

WDS Limited (WDS)

2006

|

|

|

|

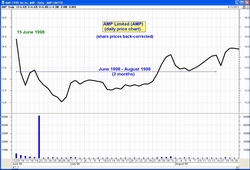

AMP Limited (AMP)

www.amp.com.au (About AMP)

15 June 1998 - demutualised.

12 December 2003 - demerged.

|

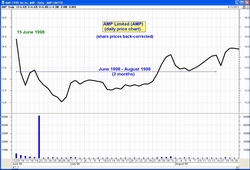

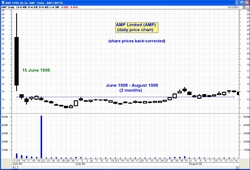

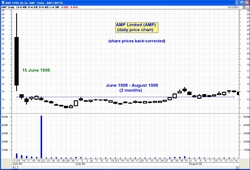

AMP - The first 2 months

(daily line chart)

Note: Share prices have been

back-corrected due to the

2003 demerger (and possibly other

capital reconstructions). |

AMP - The first 2 months

(daily line chart)

Note: Share prices have been

back-corrected due to the

2003 demerger (and possibly other

capital reconstructions). |

AMP - The first 5 years

(weekly

line chart)

AMP - From

demutualisation

to November 2013

About 15 years

(weekly line chart)

|

Telstra Corporation (TLS)

www.telstra.com.au

T1 - 1997 (the offer document)

Offer price $3.30 (max price in two instalments)

T2 - 1999 (the offer document)

Offer price $7.40

T3 - 2006 (the offer document)

Offer price $3.60

More details about the prospectus offer documents at www.telstra.com.au

Highlights:

- Float 1998

- Rising share price initially, then a long term

downtrend.

- Downtrend until November 2010 with two more public

offerings along the way.

|

TLS - The first 3 months

(daily line chart) |

TLS - The first 3 months

(daily line chart) |

TLS - From it's peak in

1999

to it's lowest close in

2010

(weekly line chart)

TLS - From it's peak in

1999

to November 2013 showing

a rising price since Nov 2010

(weekly line chart)

|