Santa

Rally

- over recent years

(Toolbox

Members click on any charts for a larger version

in a new window) |

Observations

and

comments |

The Hirsch

Santa Rally

7 trading days

The last 5 days of one year, and

the first 2 of the new year. |

Weekly candle charts

Many of the charts in this column cover the

period August - February/March (8 months)

so it is easier to compare year to year

down the column. |

Additional charts

(time period may vary) |

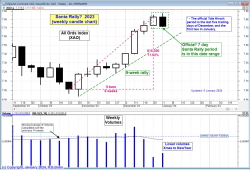

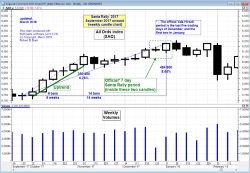

2025

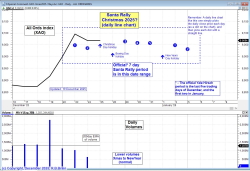

Santa Rally in 2025? Conclusion: There

was a small rally over the specific 7-day period, but the

index performed much better in the period from May to

October which is traditionally the period that

commentators refer to as the "Sell in May..." period.

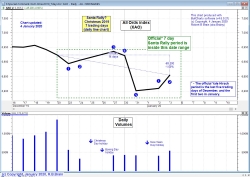

9 January 2026 - We have now completed

the Hirsch Santa Rally 7-day period, and the XAO index was

up 0.38 per cent over those specific 7 days - so we could

say that a small Santa Rally did take place. Also, study

the first chart carefully and notice that the index rose

(by 1 per cent) on 23 December (day '1' of the 7-dayy

period), then drifted lower over the 5 numbered trading

days.

3 January 2026 - With one trading day to

go in the official Santa Rally period, there appears to

have been no rally this year. In the first chart at right

we can see a dip between the Christmas Day / New Year Day

period and the New Years Day holiday. The market

performance on the 5th January will be interesting.

19 December 2025 - What to expect this

year? What is in store for the Christmas period and

beyond?

|

The Yale Hirsch rally?

7 days (daily chart)

|

August 2024 - early January 2025

(weekly candle chart)

The index fell in Feb-March-April 2025, then suffered from

President Trump's Liberation Day. This was followed by a

strong rally in a peak in October., before a market fall

into November.

|

(longer term chart pending)

(weekly candle chart)

|

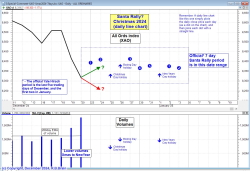

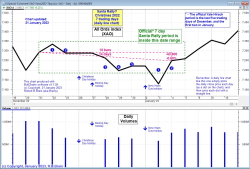

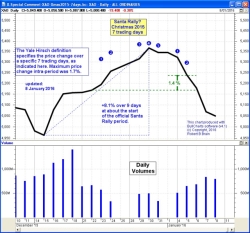

2024

Santa Rally in 2024?

May 2025 - The final chart at right shows

that the index rallied some more through January, then

fell heavily through February and March.

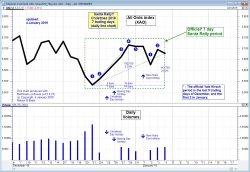

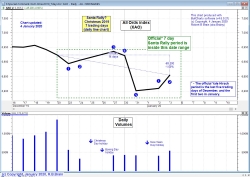

11 January 2025 - The updated first chart

at right shows the index continued the Christmas-time

rally and rose a little further. While the second chart

includes the latest weekly candle which is sitting at the

upper end of the range of the previous three candles -

indicating a rally over that period.

4 January 2025 - The first chart at right

shows the official Santa rally period for the XAO index,

where the index was up 2.35 per cent over the official 7

trading day period. So, we did see a Santa rally in 2024.

21 December 2024 - What to expect this

year? The market has already rallied some 7 per cent over

10 weeks from August 2024 until mid-October (see the

second chart at right). After a short 2-week retracement

it then rallied another 3.8 per cent into late November

before selling off in early December. What is in store for

the Christmas period and beyond?

|

The Yale Hirsch rally?

7 days (daily chart)

Here is what happened over the official

Santa Rally period.

The index was up 2.35 per cent.

|

August 2024 - early January 2025

(weekly candle chart)

The index was up 7 per cent over 10 weeks from August

2024, then another 3.8 per cent in November.

|

August 2024 - April 2025

(weekly candle chart)

After the official 7-day Santa rally period, the index

rose 3.3 per cent to a peak in early February, then fell

11 per cent in late March. Then Donald Trump's Liberation

Day struck, and created the long-tailed spike-low doji

candle in the first week of April, before rallying some

more. |

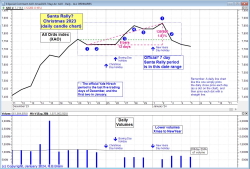

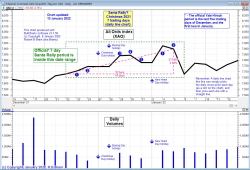

2023

Santa Rally in 2023?

July 2024 - Once the 2023 Christmas New

Year period had passed with the index falling in very

early January, the index then rallied about 6 per cent

through February and into March, then stalled for a few

months.

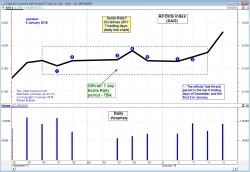

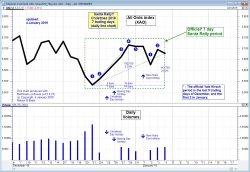

6 January 2024 - The official Santa

Rally* period has now ended and the index was flat - from

the close of trade on 20 December (see the updated first

chart at right), the index fell into day "1" of the

period, then rallied 1.8 per cent over days 2, 3, 4, 5 and

then the first day of the New Year; but then fell heavily

on the the final day of the official period. In the second

chart at right we can see the nice extended Christmas

rally over 9 weeks from late October to be up 11.6 per

cent before falling in the first week of January (the

black candle).

30 December 2023 - We are part way through the

official Santa Rally period, and the index is higher.

Also, the middle chart is updated to show the now 9-week

rally.

23 December 2023 - How will the official

Santa Rally period pan out this year? The first chart at

right will firstly be the snap shot on 30th December (not

there yet). In the lead up to the official Santa Rally

period, the index has rallied nicely - by 10 per cent. The

middle chart at right shows this - the XAO index on a

weekly candle chart with the index rallying for 8 weeks

from late October.

|

The Yale Hirsch rally?

7 days (daily chart)

The index was flat over the official

Santa Rally period.

The index was up 1.81 per cent.

|

September 2023 - early January 2024

(weekly candle chart)

The index rallied 11.6 per cent over the

9 weeks leading up to Christmas,

then fell in the first week of January.

|

Sept 2023 - June 2024

(weekly candle chart)

After the 2023 Christmas period.

|

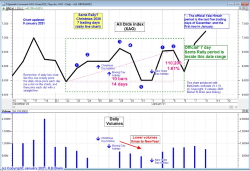

2022

Santa Rally in 2022

July 2023 - The third chart at right shows

what happened after the Christmas period finished. The

index rallied for 5 weeks, and then was range bound for

months.

21 January 2023 - The first two

charts at right have been updated. The Santa Rally did not

transpire, as explained on 7 January below. The second

chart clearly shows the 9-week rally before Christmas,

then a 4-week downtrend (retracement) leading into the

official Santa Rally period, then a nice rally after

Christmas - for at least 3 weeks.

7 January 2023 - The first chart at right has

been updated to show the key seven days of the Yale Hirsch

Santa period. Over these 7 trading days, the All Ords

(XAO) index lost 0.6 per cent - no Santa Rally this

Christmas.

30 December 2022 - How will the official

Santa Rally period pan out this year? The first chart at

right is the snap shot on 30th December. In the official

Santa Rally period, the index has fallen. We have two more

trading days to watch for. The second chart at right shows

the XAO index on a weekly candle chart with the index

rallying for 9 weeks from 3 October to late November.

|

The Yale Hirsch rally?

7 days (daily chart)

The index fell 0.6 per cent.

|

September - 30 December 2022

(weekly candle chart)

|

August 2022 - July 2023

(weekly candle chart)

After the 2022 Christmas period,

we saw a 5-week rally, then nothing.

|

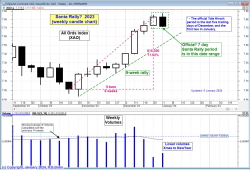

2021

Santa Rally in 2021

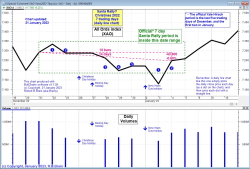

8 January 2022 - The first chart at right is

now updated to show that the index rallied about 2.8 per

cent over the official Santa Rally period, which ended the

day before the index fell heavily - back to where it was a

few days prior.

The second chart at right now shows that the index traded

in a range for the lead up to December, then there was a

5-week rally leading into the Christmas period.

1 January 2022 - The first chart at right has

been updated to show the latest market performance. Note

that there has been a rally in recent days, and that a

Santa Rally might indeed be under way. But we need to wait

and see the market performance on the next two trading

days.

25 December 2021 - How will the official

Santa Rally period pan out this year? The first chart at

right is the snap shot on Christmas Day (25 December),

with the index rallying over the first two days of the

period.

|

The Yale Hirsch rally?

7 days (daily chart)

The index was up 2.8 per cent.

|

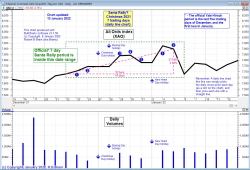

June 2021 - early January 2022

(weekly candle chart)

The index traded in a range in

the period from July to December 2021,

then rallied for about 5 weeks over

the Christmas New Year period.

|

July 2021 - November 2022

(weekly candle chart)

After the 2021 Christmas period,

the 5-week market rally

failed to continue.

|

2020

Santa Rally in 2020

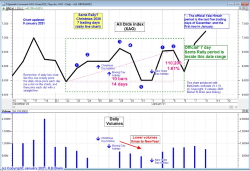

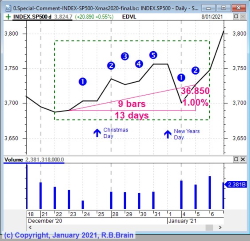

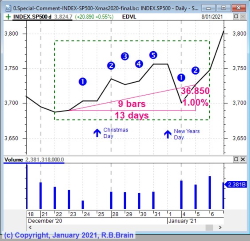

9 January 2021 - Over the strict Yale-Hirsch

period the Australian market rallied 1.6 per cent, even

though the trading was within the confined congestion

range that was in place for all of December. The first

chart at right shows the daily moves of the index in this

period. Also, the American S&P500 index was up 1 per

cent, noting that they did not have a holiday break on our

Boxing Day Monday, so there 7-day count started one day

later than ours.

2 January 2021 - At this stage we are

part way through the official Yale-Hirsch Santa Rally

period, and there is no true "Santa Rally" apparent on the

Australian market - but there are still two trading days

to go.

2 January 2021 - The middle chart at

right shows the lead up to the 2020 Christmas season. The

market fell off a cliff in late February and March 2020

due to the global coronavirus pandemic. Then our market

rallied some 40 per cent over the following 40 weeks.

|

The Yale Hirsch rally?

7 days (daily chart)

The Aussie index was up 1.6 per cent

for these 7 trading days.

The S&P500 index

was up 1 per cent over

over the official Yale-Hirsch

7-day Santa Rally period.

|

March 2020 - early January 2021

(weekly candle chart)

The index was up 45 per cent

from the March 2020 (coronavirus) lows

until 8th January 2021.

|

March 2020 - June 2021

(weekly candle chart)

After the 2020 Christmas period,

the market rally continued for at

least several weeks.

|

2019

Santa Rally in 2019

11 January 2020 - Well, perhaps there was

no official Yale-Hirsch Santa rally on the local Aussie

market at the end of 2019, but the push to new all-time

record highs on 10th and 11th January indicate that an

uptrend from August is continuing (see the middle chart at

right), and some people might refer to this longer term

rally as a Christmas Rally, or Santa Rally. So perhaps we

can say that we have had one.

4 January 2020 - Well, the official

window for the Yale-Hirsch Santa Rally has now passed and

there was a fall in our local market over the 7-day period

- so no Santa Rally (see the first chart at right).

However, the next chart at right shows the S&P500

index over the same period and a rise of 0.34 per cent -

so the Yale-Hirsch Santa Rally did occur on the US market.

28 December - The chart "July-November

2019" at right is updated this week, in anticipation of

the market performance next week. Whatever happens, we can

see that the local market index has actually been rallying

(on this weekly chart) since the lows of 12th August.

Also, the chart at far right is the S&P500 index on

the US market which shows a strong rally since early

October - which some people might call a "Santa Rally"

because the market is rallying at around Christmas time.

20 December - Nothing has changed since

the last update on 14 December below.

14 December - In some years a pseudo

Santa Rally is under way by now. A year ago, the market

was crashing in December. And so far this year there is

not much to report at this time.

30 November 2019 - Will we see a Santa

Rally in 2019? Given that the index has performed so well

lately (up 7 per cent since early August 2019).

|

The Yale Hirsch rally?

7 days (daily chart)

The S&P500 index

over the official Yale-Hirsch

7-day Santa Rally period

|

July 2019 - early January 2020

(weekly candle chart)

|

S&P500 (US) index

28 Dec 2019 - Long-running American bull market

|

2018

Santa Rally in 2018!!

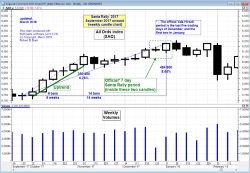

4 January 2019 - Well, the official Santa

Rally period has finished, and we have seen a Santa Rally

on the Australian market. The first chart at right shows

that even though we had a maximum increase of 3.3 per cent

during the period, the actual market increase over the

official 7 days was 2.6 per cent. Now, for anyone who

considers that a Santa rally could be valid over a longer

time period at this time of year can go hunting for it -

there are still a few possible days left.

29 December 2018 - Well now, who would

have thought that? With our market falling heavily in

recent weeks, the index has just rallied 3 per cent in the

latest week, and this qualifies for the title of Santa

Rally. But the precise definition for a Santa Rally covers

a 7-day trading period which has three more days to go. So

let's watch and see...

22 December 2018 - The first chart at

right shows that the official Yale Hirsch Santa Rally

period has now started - on Friday 21st - with the index

falling 0.7 per cent. The chart at far right has been

updated to include the latest week.

15 December 2018 - The candle chart at

far right shows the performance of the XAO index since

June 2018 - a market peak in August, then an 11 percent

fall into a market correction by mid-December.

|

The Yale Hirsch rally?

7 days (daily chart)

|

August 2018 - August 2019

(weekly candlestick chart)

This chart shows the strong downtrend through August to

December 2018

into Christmas Eve,

followed by a strong multi-month

uptrend of 24 per cent

to new highs in July 2019.

The official Yale-Hirsch Santa Rally is one thing, but the

subsequent uptrend is something else again. |

June - Dec 2018

(weekly candlestick chart)

This updated weekly candle chart

shows the market peak in August

and the fall of 14 percent into a

market correction before Christmas.

|

2017

Will we see a Santa

Rally in 2017?

22 December 2017 - Somewhat similar to one year

ago, the Australian index already showed a rally in a

period prior to the Christmas season - in this case from

early October (second chart at right). Some commentators

have referred to this as a Santa Rally.

30 December 2017 -

With three trading days in the latest week, and two more

days to come in the official Santa Rally period, the

Australian market index has been mostly sideways in recent

days.

6 January 2018 -

Throughout the official 7-day period, we did not see a

rally on the Australian market. However, on the very next

day the index was up 0.7 percent, and a decent rally is

indicated (you can just see the last point on the first

chart at right).

|

The Yale Hirsch rally?

7 days (daily chart)

|

October 2017 - onwards

(weekly candlestick chart)

(to 6 January 2018)

This chart shows an uptrend in place

from early October 2017, with an

increase of 6.3 percent in

the initial uptrend until early November,

and then a further 1 percent increase.

Then another rise in early January outside the official

Santa rally period, taking the uptrend from early October

to 8.44 percent over 14 weeks. |

Sept 2017 - Feb 2018

(weekly candlestick chart)

This daily candle chart

(from September 2017 to

early February 2018)

is very similar to the one at left,

and it shows what happened after

the official Santa Rally period - there was a fall in the

market, effectively terminating

any uptrend and rally that

might have been in place.

|

2016

Did we see a Santa

Rally in 2016?

17 December 2016: The Australian index already

showed a rally from early November. Some commentators

referred to this as a Santa Rally.

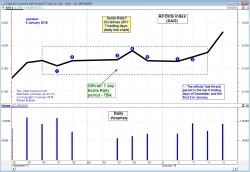

5 January 2017:

The Aussie index rallied 1.7 percent during the official

Santa Rally Period.

20 January 2017: A

Santa Rally occurred (according to the strict Yale Hirsch

definition), and for anyone in the market prior to this,

the index rallied somewhat further. And the rally

continued even further until the second week of January.

(The index actually rose 11.8 percent from trough to peak

on the daily chart - November to early January).

21 April 2017:

From early January, the index continued higher (see third

chart at right).

|

The Yale Hirsch rally?

7 days (daily chart)

A good market rally in the lead up to the official 7-day

period; but what about the official 7 days? (see the chart

above)

|

July 2016 - onwards

(weekly candlestick chart)

(updated 23 December 2016)

This chart shows an uptrend in place from the time of

the US Presidential election (early November). Many

commentators have already called this a Santa Rally. |

2016 - 2017

(daily candlestick chart)

A weekly candle chart from July 2016 to April 2017,

showing that after the uptrend marked on the previous

chart (at left), and also after the official 7-day Santa

Rally period, the index continued to trend higher, albeit

at a slower pace than from November to early January.

|

2015

Did we see a Santa Rally

in 2015?

The Australian market certainly rallied for a

period of time in December 2015.

The index rallied 8.1 percent of 9 consecutive trading

days, commencing on 15 December. We could call this a

Christmas Rally, or even a Santa

Rally using the loose definition of the term.

Update: February 2016.

Referring to the middle chart at right, note the bigger

downtrend in place prior, and persisting after, the Santa

Rally.

|

The Yale Hirsch rally?

7 days (daily chart)

A 1.4 percent increase over this 7-day period.

|

February 2015 - February

2016

(weekly candlestick chart)

This chart shows that after hitting a resistance

level below 6000 points in March-April 2015, the index

trended

lower (a confirmed downtrend of

lower peaks and troughs).

We can now see clearly that the apparent Santa Rally in

late December was merely a short term rally (retracement)

within the bigger down trend. |

(relevant chart

pending) (relevant chart

pending)

2015 - 2016

(daily candlestick chart)

A daily candle chart from mid-October 2015 showing a

downtrend through November to a market low on 15 December.

Along the way, there was a 5.2 percent rally in

mid-November (retracement of the down trend).

|

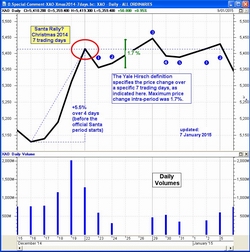

2014

Did we see a Santa Rally

in 2014?

The chart in the middle at right is a weekly from

October 2013 and shows how weekly volumes fall off in the

Christmas New Year period. On this chart we can see in

August 2014 the index topped, then fell heavily into

September, then rallied for a couple of weeks but failed

to reach the August highs, then fell heavily in early

December. At this point most people had given up hope of a

Santa Rally.

Update: 17 January 2015.

The first chart at right shows that there was no Santa

rally (according to the Yale Hirsch definition), while the

second chart shows a 4 percent rally over 4 weeks from

mid-December to mid-January, followed by a sharp fall (of

3 percent in the latest week).

Update: March 2015.

The third chart at right is a daily candlestick chart from

November 2014 to February 2015. It clearly shows that a

meaningful rally started on 21st January 2015, and the

index rose with 10 consecutive white candles (the close

price above the open price), with the index rising 10

percent over the 4 week period.

|

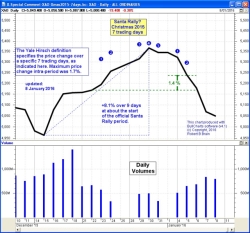

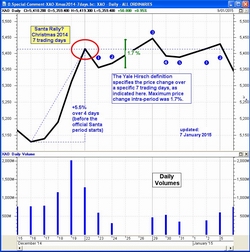

The Yale Hirsch rally?

7 days (daily chart)

After the seventh day of this period, the index

is about where it started several days earlier. As

per this definition of the Santa

Rally, there was none. The chart here shows a

maximum range in index value of 1.7 percent over the seven

days (but this doesn't count). |

September 2014 - January

2015

(weekly candlestick chart)

This chart shows the index movements from a peak in

mid-August, to a trough in early October, then a lower

peak in early November, and another trough in early

December. From this low, the index rallied 4.68 percent

over four weeks until 9th January, then fell 3 percent. In

the broader definition of a Santa

Rally, it might be possible to argue that we have

seen a rally, albeit a short one. |

November 2014 - February

2015

(daily candlestick chart)

A more meaningful rally started on

21 January, with the index rising 10 percent over 4 weeks.

You could hardly call this a Santa

Rally, but for anyone watching the market, a

successful investment could have been possible.

|

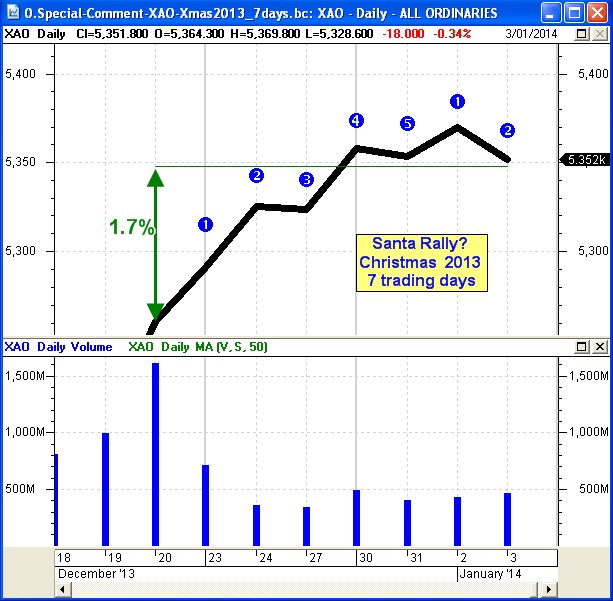

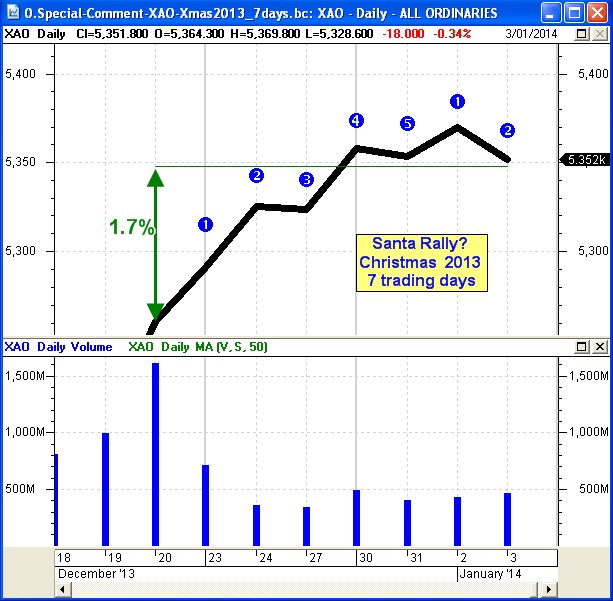

2013

A

so-called Santa Rally was evident this year.

Firstly, as defined by Hirsch (see

above), we saw a 1.7 percent increase over these 7

trading days of the season (see the first chart at

right). If we accept a looser definition, then we can see

a short rally was underway through late December (see the

other two charts).

The second chart also shows a regular rally from June to

November 2013 (11 percent increase), which was then

followed by a short retracement in late September, then

another short (4 week) rally until a top at about 5400 in

late October.

|

The Yale Hirsch rally?

7 days (daily chart) |

June 2013 - February 2014

(weekly chart) |

Detail

November 2013 - January 2014

(daily chart) |

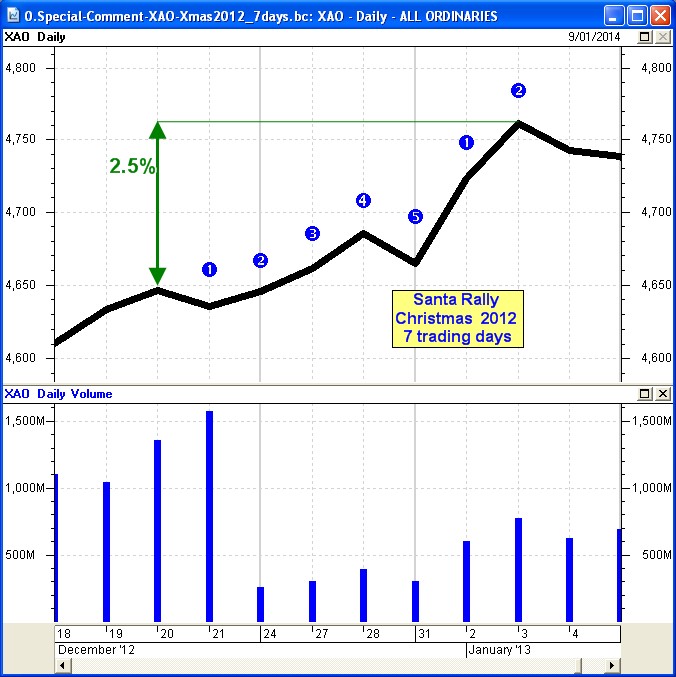

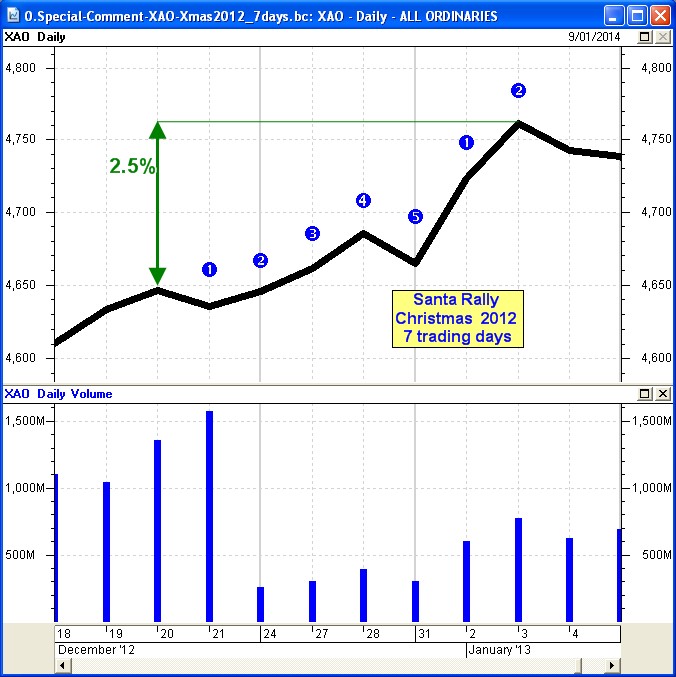

2012

A Santa Rally was evident in 2012, with the index trending

strongly higher.

The second chart at right clearly shows two rallies in

late 2012. A prolonged rally that started in June,

until a high in mid-October and a 4-week retracement.

Then a 15 week rally with only one black candle, and

a rise of about 16 percent over the 15 weeks. This rally

started in mid-November and topped out in early March

2013.

|

The Yale Hirsch rally?

7 days (daily chart) |

June 2012 - March 2013

(weekly chart) |

(no

chart

here) |

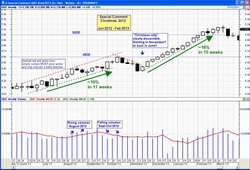

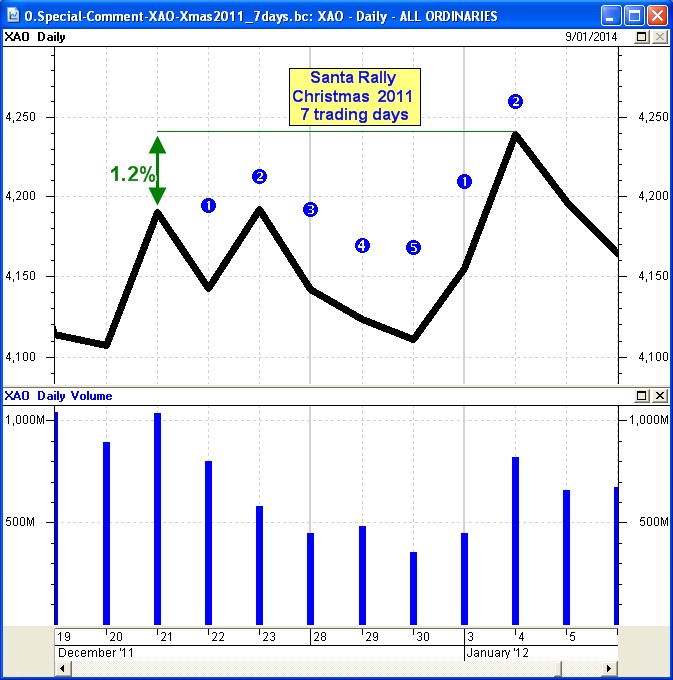

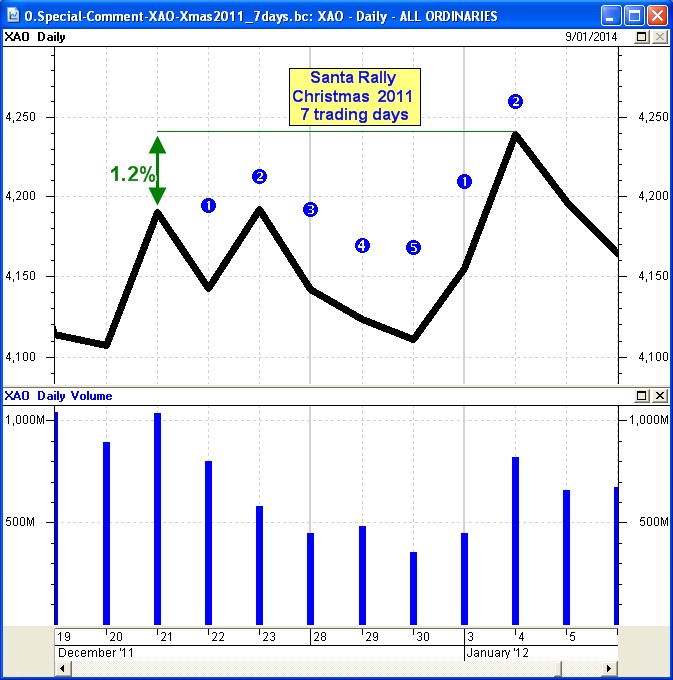

2011

The first chart at right shows how the index moved over

the Hirsch 7-day trading period - initially trending

lower, before a sharp 2-day rally to result in a Santa

Rally being completed. Actually, if it wasn't for the

sharp move higher on January 4th, the Santa Rally would

not have confirmed.

The second chart at right shows the bigger picture and a

Symmetrical Triangle chart pattern in the period August to

December 2011 - indicated by the two dotted lines which

contain the price action and tend to converge (this

pattern indicates progressively more agreement on price

between buyers and sellers).

The third chart shows a general rally over the four week

period in early to mid-January, and clearly shows a trend

line under the rising price action from a low on 20

December (which was re-tested on 30 December). [This trend

line is drawn under the daily lows to capture all traded

values.] The price action first breaks down across this

uptrend line on 2nd February to indicate a weakening of

the trend, then closes below the trend line on the 10th.

The maximum rise in this period was 6.3 percent. During

February and early March the index fell to test the 4250

support level on two occasions, then rallied again to

higher highs in early May, after which it fell more than

10 percent (a correction). |

The Yale Hirsch rally?

7 days (daily chart) |

August 2011 - March 2012

(weekly chart) |

Detail - December 2011 -

April 2012

(daily chart) |

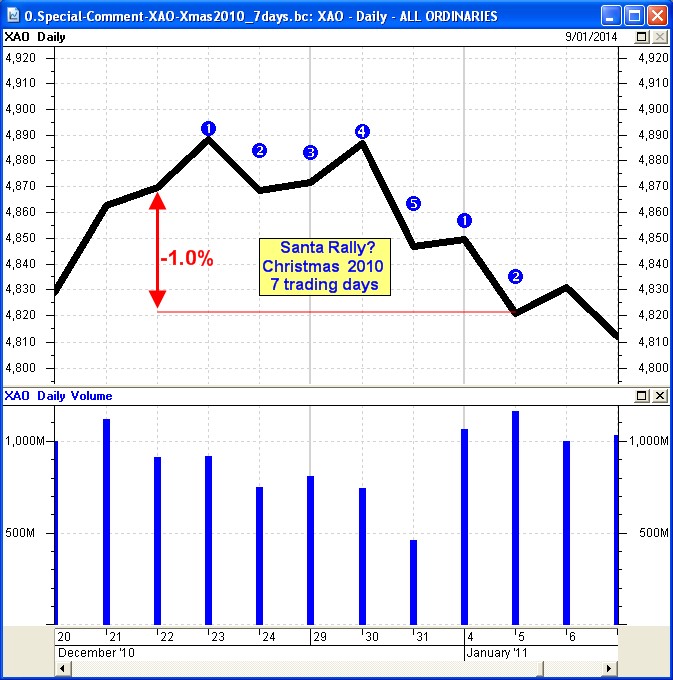

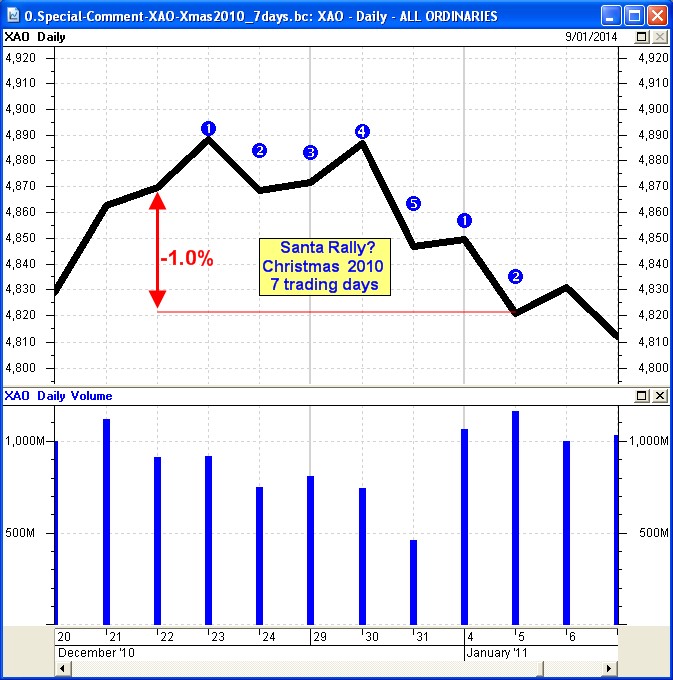

2010

The first chart at right is the Hirsch 7-day Santa Rally

period, showing a decline over these 7 days - no Santa

Rally.

This volatility over the Christmas period is not all that

obvious in the second chart at right (a weekly chart); but

the third chart (a daily) clearly shows the highs (and

lows) within each week (the daily extremes of price).

From a low on 1st December, the index rallied 4.8 percent

to a high on 23 December, then fell away on falling

volumes to sit above 4800 through the first week of

January. The index then rallied again to another high on

19 January, then fell away over a 2 week period, then

rallied strongly yet again to a high on 17 February (well

after the Christmas period). After this high, the index

fell 8 percent to be lower than it's starting point on 1st

December.

|

The Yale Hirsch rally?

7 days (daily chart) |

August 2010

- February 2011

(weekly chart) |

Detail - December 2010 -

March 2011

(daily chart) |

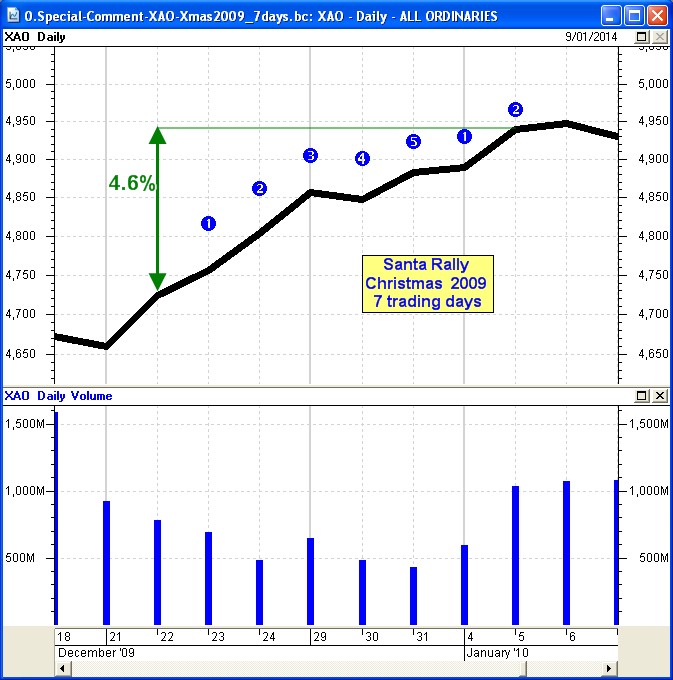

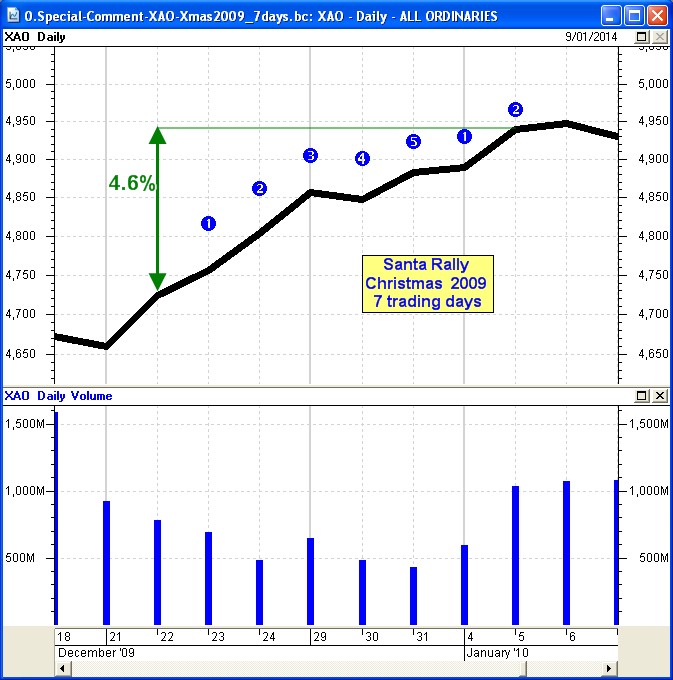

2009

The first chart at right clearly shows the Hirsch Santa

Rally with higher closing prices almost every day over the

7 day period.

In the bigger picture (second chart at right) we can also

see that a broader rally took place from August 2009 to

early October - well before the Christmas period. Followed

by lower peaks through October and November but sitting

above support at about 4600.

In the third chart at right (a daily) we can see that an

uptrend started on 10th December with a peak on 11 January

- a 7.7 percent increase over 32 days (19 candles). This

included a sequence of 7 strong white candles out of 8

from 22 December until 5 January. And on much lower

volumes.

So much for investors and traders taking holidays over the

Christmas New Year holiday period. But note the sell-off

that followed in late January. |

The Yale Hirsch rally?

7 days (daily chart) |

August 2009 - February

2010

(weekly chart - every candle summarises

the price action for one week) |

Detail - December 2009 -

Jan 2010

(daily chart - every candle summarises

the price action for one day) |

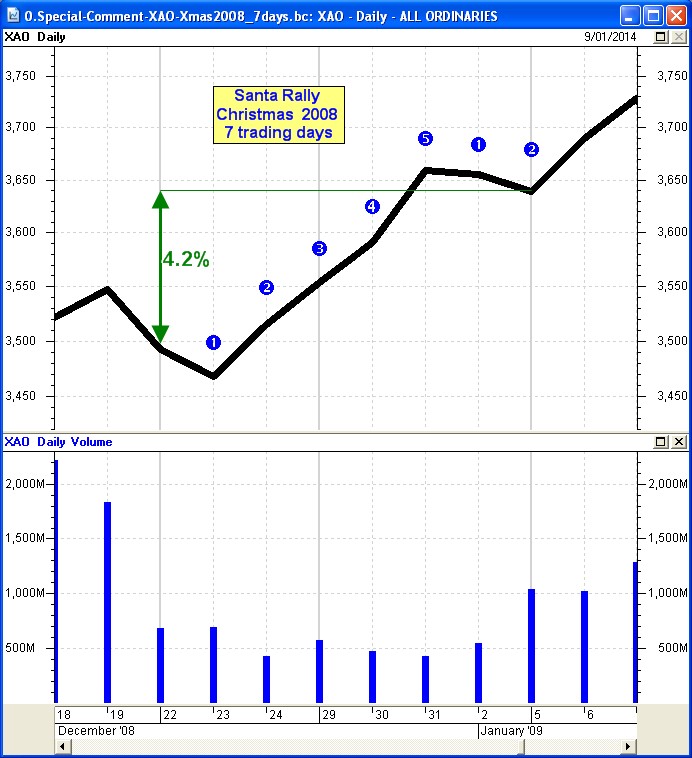

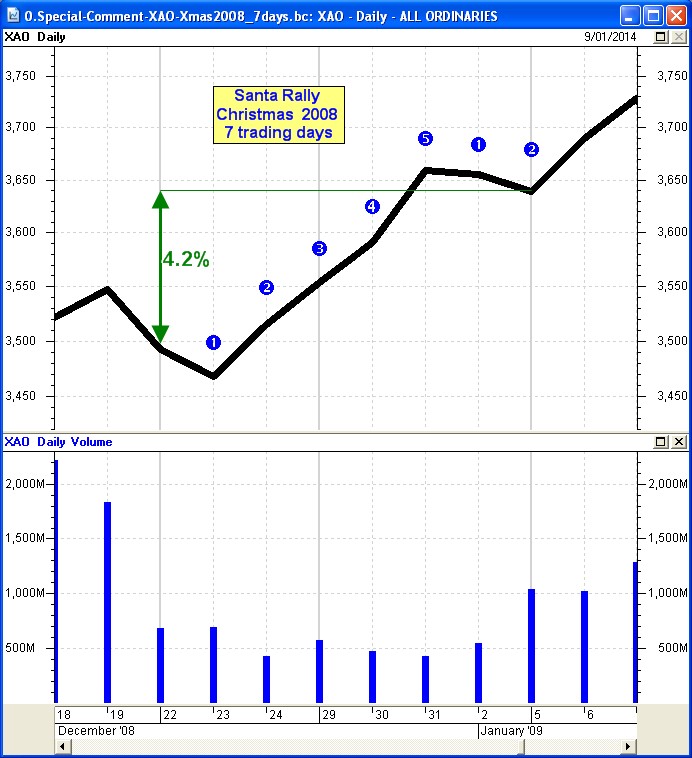

2008

The first chart at right clearly shows the Hirsch Santa

Rally over that 7 day period.

However, in the bigger picture chart (the second one at

right - a weekly chart) we can see a downtrend in place in

the last few months of 2008 (about the time of the Lehmann

Brothers issues). So, even though a down trend existed, a

Santa Rally (a relief rally) still took place during this

Christmas period.

|

The Yale Hirsch rally?

7 days (daily chart) |

August 2008 - February

2009

(weekly chart - every candle summarises

the price action for one week) |

(no

chart

here) |