Blue

chips falling...

|

BHP Billiton - Massive

disappointment

Who would have thought that Australia's goliath stock BHP

Billiton could have suffered the share price decline that it

experienced in 2015.

Could we have anticipated this? Well, perhaps we might not

have forecast that this cold happen; but the technical

analysts amongst us could have seen a down

trend developing, and protected our capital by closing

the position before it got drastic (perhaps by using the Stop Loss approach).

See the next price chart below for more details.

|

|

BHP Billiton - protecting our

capital

We could have used key information in the price chart of BHP

Billiton to protect our precious investment capital from the

sharp share price slide from 2012 onwards.

The price chart at right includes some text to explain the

concepts of how we could use the price chart features to do

this (Toolbox Members click for a larger version).

|

|

CSL (2026) - Key for many

investor portfolios

CSL has been considered a blue chip stock for many years. In

February 2026 CSL had fallen significantly in recent months

and many investors and commentators were questioning whether

it should continue to be referred to as a blue chip

stock. The quarterly* price chart at right shows that the

CSL share price was trading up around about $250 to $320

during 2021, 2022, 2023 and 2024; but then to-date has

fallen about 50 per cent in 2025-2026 from the recent highs

to about $152 in early 2026. That's a fall of around 50 per

cent! (A $10,000 position would have been halved to around

$5,000!). Is there more to this than shown in this price

chart? Should it be scratched from our list of blue

chip stocks? If I held a position in CSL should I

sell it?

For further discussion about the CSL price drop in

2025-2026, see the Blue Chip shares Disappointing?

web page.

* - On a quarterly candle chart, each candle summarises the

price action in one (3 month) quarter.

|

|

Consumer Staple stocks are safe

- aren't they?

Now, it's supposed to be a good idea to buy Consumer Staples

stocks because of their resilience in good times and bad.

However, the price chart of Woolworths (WOW) at right tells

us otherwise.

|

|

The

details

below talk about the blue chip stocks that fell during the

GFC. And the stocks in the right-hand column are good

examples of what can happen to blue chip stocks at any time,

not only during a GFC.

|

|

Blue

chips that fell more than 50% in GFC...

|

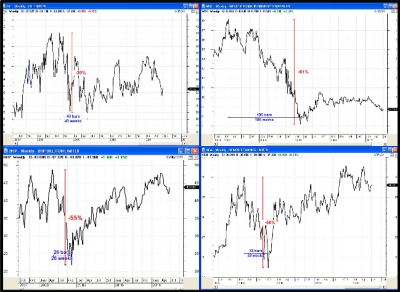

A number

of Australia's blue chip stocks fell more than 50% during

the Global Financial Crisis (GFC) of 2008-2010+.

There are two sample stocks shown in the price charts at

right:-

- AMP fell 64% in 78 weeks

- CBA fell 60% in 64 weeks

And at the time of writing this material (July 2011), these

blue chip stocks were still under their highs of almost 3

years earlier.

Actually there are

quite a few blue chip stocks that fall into this category,

not just the two samples here. The collage of four stocks at

right are just four more examples of falling blue chips.

These four fell between 30% and 60% over periods between 26

and 106 weeks. At the time of writing here, a couple of

these are still well down, and a couple are close to

recovering to their past highs (after about 3 years!).

Which stocks are these four?

NOTE: For the purpose of studying "blue chip" stocks here,

we are looking primarily at the Top 50 Australian stocks -

the XFL

index (S&P/ASX 50). Also, there are probably a few

more stocks that fall into this category, and which are not

listed here.

|

AMP

(click for a larger view) |

CBA

(click for a larger view) |

See more in

the Toolbox Member area.

Four more falling blue chips.

See these and more falling blue chips in

the Toolbox Member area. |

|

Blue

chips can remain below past highs...

|

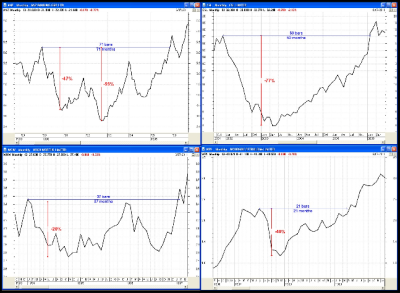

Over the last

25 years or so a number of Australia's blue chip stocks

fell more by a large amount, and did not regain their old

highs for many months, or even for years!!

There are two samples at right:

- Westpac bank (WBC) fell 54% over a 4 year period, and

took a total of 7 years before it made new highs and

stumbled again the following year.

- Telstra (TLS) is that one stock that has fallen 71%

over 11+ years, and is still not looking like making new

highs anytime in the near future. Anyone who invested in

the initial T1 float has seen their capital destroyed.

Likewise in both T2 and T3, even after the government

and some advisers and brokers recommended investor

partipication.

The collage view of

four stocks at right shows just four more blue chip stocks

that fell a long way, and which took a long time to attain

new highs.

Which stocks are these four?

NOTE: For the purpose of studying "blue chip" stocks here,

we are looking primarily at the Top 50 Australian stocks -

the XFL

index (S&P/ASX 50). Also, there are probably a few

more stocks that fall into this category, and which are not

listed here.

|

WBC

(click for a larger view) |

TLS

(click for a larger view) |

See more in

the Toolbox Member area.

Four more fallen blue chips that took a while to

recover.

See these and more that took a while to

recover in

the Toolbox Member area. |

|

class="ht14"

class="ht14"