And whatever you do,

beware of the sharks in the ocean!

|

Food for thought

Before you get too far through the great material

below, here is a little more food for thought:

Can I invest my SMSF funds in the share

market?

It might be possible to invest SMSF funds in the

share market, either for the long-term or maybe

for short-term profits. It depends on a few

things, including the SMSF documented investment

strategy. See some key information here in the Toolbox.

|

The (disappointing)

truth about blue chip stocks

Did you realise that:

- There is no strict definition of the term blue

chip.

- Blue chip stocks are not all they are

cracked up to be.

- Too many blue chip stocks fell significantly

during the GFC, so any investor/trader who

relied on good capital gains would have been

disappointed.

- Even blue chip stocks can tumble, and stay

stuck below recent highs for years.

See lots

of details and some real charts explaining

all this about blue chip stocks.

And what's the conclusion? It might be worth

spending a little more time to find investable

stocks further down the list of stocks.

|

About the share

markets (equity markets)

The Australian market

Australian

market operators - Since late October

2011 there have been two major share

market operators in Australia (ie. an

organisation which offers a facility whereby the

orderly exchange of company shares and derivatives

can take place). There are also smaller

specific-purpose market exchanges / operators.

- Australian

Securities Exchange (ASX) - This is the

major market exchange in Australia and used by

the majority of share market investors,

and

- Cboe

Australia - The newer market exchange in

Australia that opened in direct competition to

the ASX in October 2011. Originally known as

Chi-X Australia, and rebranded to Cboe Australia in

February 2022.

- National

Stock Exchange of Australia (NSX) - An

exchange specifically focused on small to

medium enterprises.

- Asia

Pacific Stock Exchange (APX) - An

exchange that operates in the Asia-Pacific

region providing opportunities for growth

oriented companies to raise capital.

Other markets

For information on other markets, see details at world-stock-exchanges.net.

Aussie

and overseas market operating hours and

holidays

The ASX Trading Calendar

- A list of the trading days/holidays in

the current year, and early finishing

times when appropriate. Also see the

various ASX options and expiry

calendars.

In addition to the ASX, Cboe Australia

(formerly Chi-X Australia) now handles a

large portion of trades in Australia. See

the Cboe Market Holidays

notices.

Time

of day on key world stock markets -

Brainy's web page showing a list.

World

markets hours diagram (at

right) World

markets hours diagram (at

right)

Operating status of some

market exchanges

(at www.premiumdata.net)

Daylight

savings time adjustments around

the world

at: wwp.greenwichmeantime.com

NYSE

Holidays and Hours - Holidays and

hours for the coming months.

ASX Trading Hours and

Market Phases - A list of the

various phases that the market moves

through in each trading day from the

Pre-Open Phase through Normal Trading to

After-Hours. All securities start trading

at around the same time on a trading day,

For detailed information about how the ASX

starts trading each day, see the ASX website here.

This changed in June 2025

- Prior to June 2025, the Opening Phase of

the Australian market at 10am was one of

great interest to local investors and

traders. This staggered market open was

changed in June 2025, so that all

securities now start trading at around the

same time on a trading day, and not in a

staggered method as explained here: [This

information is left here as a historical

reminder of how it used to be.] The

Opening Phase of every day's market

trading started at 10:00am and lasted for

about 10 minutes. The listed securities

commenced trading in five different

groups, depending on the first letter of

their ASX code as follows:

- Group 1 - 10:00:00am +/- 15 seconds

- all securities starting with a digit

0 to 9, or the letter A or B (eg. ANZ,

BHP).

- Group 2 - 10:02:15am +/- 15 seconds

- those starting with a letter in the

range from C to F

(eg. CPU, FXJ).

- Group 3 - 10:04:30am +/- 15 seconds

- those starting with a letter

from G to M (eg. GPT).

- Group 4 - 10:06:45am +/- 15 seconds

- those starting with a letter

from N to R (eg. QAN).

- Group 5 - 10:09:00am +/- 15 seconds

- those starting with a letter

from S to Z (eg. TLS).

World holiday dates at TimeAndDate.com.

|

SPI Futures - Information

about various ASX options contracts including the

SPI (Share Price Index) futures contract,

including the exercise timetable.

Brainy's

web page portal listing lots of web

pages for daily use to check on the market, and to

help with research.

Share Market

GEMS (summary list) - A summary list of

cliches and infamous share market tips (is 2 pages

when printed).

The Toolbox Members full version

(MA*) includes more details and explanations for

these share market GEMS.

Lotsa Web Links (MA*)

- A pdf file listing over 200 different and useful

web sites on a whole range of investing and

trading topics.

Robert has more

publications available. Some for free and

others for just a very modest fee. Many are

free to Toolbox

Members.

|

The share market indexes

See

market index details and history for more

information about:

- General information about our share market

indexes

- "top stocks"

- Market indexes and sectors

- ASX Indexes - Composition - How are all the

ASX indexes, and sub-indexes, made up?

- Which stocks are in each index?

- XJO - S&P/ASX 200 index

- XAO - All Ordinaries index

- Index re-balancing - recent S&P

news

- GICS codes (Global Industry Classification

Standard)

- Volatility Indexes (VIX)

- More S&P information about the

Australian Market Indices.

|

Alternatives to

share investing

At some stage, many investors think about

investing in something other than shares. This

could be a related financial instrument such as

foreign currency (FX), commodities, bonds,

warrants, options or futures contracts. The pros

and cons of these are not discussed here.

Just for interest, the range of commodities

includes:

- metals:

- copper, lead, zinc, tin, aluminium,

nickel, cobalt, molybdenum, etc.

- precious metals:

- gold, platinum, palladium, silver

- energy:

- WTI oil, Brent Crude oil, natural gas,

propane, etc.

- grains:

- rice, soybeans, wheat, cotton, coffee,

corn, cocoa, sugar, etc.

- livestock:

- other:

|

Getting started

Okay, so you think you want to take more control

of your investments, and perhaps to mange your

investments with a more hands-on approach. And

maybe even trade shares yourself. It can seem

scary; but it doesn't have to be.

"Learning how to do it

does cost time and money;

but it doesn't have to cost lots of money."

In very general terms, it is important to clearly

understand a few things like:

- How much money is available

for investing (ie. the funds)?

- How

much time do we need to devote? - See

a discussion

on the balance of time.

- Which asset classes do I want

to spread the funds across?

- What is my risk tolerance? Can

I tolerate a lot of investing risk, or not?

See the FiRT (Financial Risk Tolerance) table

in Brainy's eBook pdf number ST-2180 (see the

Member version,

or the page-1 preview).

- Which

stocks to ignore and which to focus on?

- That is, if you want to trade or invest in

shares, then how do you decide which ones to

focus on and which to ignore? See the

discussion below on Your

stocks universe.

- Do I want to take the sensible step of using

Funda-Technical

Analysis?

- Investing Plan and Strategy -

Who can help prepare a sound plan and

strategy?

See some tips

for

getting started, and more details

in some of Brainy's eBook (pdf) Articles.

- Professional advice - What

about the appropriate professional advice to

assist with planning and executing the

strategy?

- Practise, practise and more practise

- It can be very useful to gain some

confidence and experience in a safe

environment. Use paper-trading

to test out a strategy, or use back-testing

and trading simulation to test a strategy more

vigorously.

Are you Share Market Ready? Take a

look at Robert's

Share-Market-Ready checklist.

"Try to find someone who

seems fair and honest,

and who seems to make sense (sensible investing)."

Interested in share price charts,

and how to read them?

Take a look at some charting software (like

BullCharts), or

consider learning about Technical Analysis (ie.

charting).

Some pointers

Many people who start out learning about charting

suffer from information overload. Many people find

that over a 2 or 3 year period they find out

various snippets of information about charting

(Technical Analysis), and their focus is

distracted.

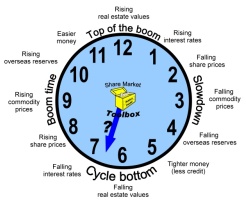

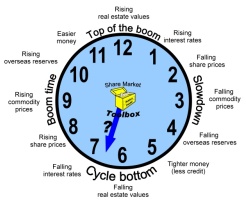

Investing

in cyclical stocks? - One of the many

strategies for selecting stocks for investment is

to monitor the economic

cycle, and the investment

clock, and to select either cyclical or

defensive stocks as appropriate. See a discussion on this

approach. Investing

in cyclical stocks? - One of the many

strategies for selecting stocks for investment is

to monitor the economic

cycle, and the investment

clock, and to select either cyclical or

defensive stocks as appropriate. See a discussion on this

approach.

Good

/ bad news can move share prices - Many

investors realise that a good news announcement

can move share prices, as can a bad news

announcement. And a good

news announcement can cause a company's

share price to

fall if the good news is not as good as

anticipated.

Intrinsic

value

(fair value) - How do we determine the

fair price for a company's shares? What about the

quoted intrinsic

value? See

a discussion here...

IPO

- Initial Public Offering - Are they

worth investing in? Some research indicates that

too many IPOs are under water for many months

after listing. Anyone hoping for nice capital

gains might be disappointed. See more details

about IPOs...

Reporting

/ Earnings season can move stocks - The

so-called reporting

season (or earnings

season) can produce news announcements

which investors like, resulting in a share

price re-rating upwards, or which investors don't

like, resulting in a negative re-rating of the

share price. Many investors watch the reporting

season in America. Note that there is a key

difference between the reporting season in

Australia, compared to the USA, as explained in

the following comparison.

| Australian

reporting season |

US

reporting season |

- Half-year

cycle - Most public companies

report each 6

months. This means that

companies will report either their interim

results (or first

half results), or their final

results (full

year results).

- Year-end

- Most public companies have a

financial reporting cycle with

year-end at 30 June each year, but

many have a year-end at 31

December. There are a few

companies who have financial year end

at different times again.

- Reporting

period - These companies are

required to report their latest

6-month finances within 60 days of the

end of the period - end-August for

most and end-February for many.

|

- Quarterly

cycle - Most public companies

are required to report quarterly - ie.

every three

months.

- Earnings

season

starts - Generally, each

earnings season starts a week or two

after the last month of the quarter.

So, for example, for the December

quarter (the three months of October,

November, December), companies

announce their earnings in January.

- Season

end? - Most companies have

generally announced their earnings

results within six weeks of the start

of the season.

- Alcoa

(a large company and listed in the Dow

Jones Industrial index) tends to kick

off each reporting season (often in

the second week of the month). This

announcement is always anticipated and

closely watched by analysts and

commentators, and rightly or wrongly

used as a barometer of the markets and

economy.

|

Author Strategies - It is a very

good idea to record your "preferred" ideas and

methods for "analysing" the market. Then they

start to crystallise. One possibility is to find a

"famous" trader / author - someone whose ideas you

like and feel comfortable with. This includes the

likes of: Alan Hull, Leon Wilson, Stuart McPhee,

Louise Bedford, Jim Berg, Frank Watkins, Daryl

Guppy, Stan Weinstein. These people are all

Australian-based (except Stan W), and they have

all published a number of text books on the

subject.

And the BullCharts software has implemented many

of their ideas and strategies as either chart

indicators, or market scans, or both. This

implementation is referred to as Author Strategies - see more

detail here...

But, one downside in heading down the track of

reading books is that in a couple of years time

you will probably have a head full of even more

ideas and will be no closer to your goal. Many

people find they have a bookshelf full of books,

that are only half read.

- Be

comfortable with spotting up trends and

down trends.

- Start

with the Weekly

Market

Analysis page in the Public area of

the Toolbox. It includes just a small

number of indicators - MA, GMMA, Momentum,

and Twiggs Money Flow (TMF).These are key

indicators, and very common (TMF not so

common).

- Follow

the

comments that are "on" the charts in the Weekly Analysis for

Toolbox Members every week (to do

this you do need to view every chart so

you can read the comments on the

charts). These are based on the

items in point 2 above. It is like

an ongoing tutorial to help you understand

these key indicators.

Why would I buy

shares?

This is a good question. Some people prefer to

invest money in managed funds, or directly into

property, or maybe share options or futures, or

perhaps forex (foreign exchange, currencies).

Many people keep it simple, and stick to

Australian shares - something they can relate to,

and which has some meaning for them. But before

doing this we should ask ourselves why we are

doing it, and have a sound plan.

A type of investment plan and strategy is

extremely important. There are a number of eBook

pdf

Articles on (Share Trading) strategies here.

|

Analysis? -

Fundamental, Technical, or

Funda-Technical Analysis

What type of analysis methods should we use?

Fundamental analysis? Technical analysis? or

what?

This a choice that befuddles many investors and

traders.

Don't forget that

Price charts

summarise the underlying opinions and emotions

of the market participants.

Every chart

tells a story. It pays to understand the

stories in the price charts.

See more information about fundamental analysis, technical analysis, and Funda-Technical

Analysis.

|

How to pick winning

shares/investments?

- Stick with something you know.

If you don't understand the product, then

either learn more about it, or avoid it.

- Successful

investors tend to have a specific mindset.

- Trends - If a stock's share

price is trending upwards, then riding the

trend can be useful. But if the price is

trending downwards, then why but it? On the

hope that it will stop trending down and turn

up at some point? See Trends details

below.

- For more GEMS like these, see Brainy's Share Market Gems.

- Take a look at Robert's

Weekly

Watch List - which he shares with Premium

Toolbox Members.

Trends and Shares

Classical Dow Theory states that if a

stock is trending, then the trend is in place

"until it is confirmed to have ended". There is a

Wall Street adage - "the trend is your friend".

Learn

the characteristics of trends, and all

about how to pick an up trend. If you can

spot a trend, and ride the trend, it is possible

to be profitable. Learn

the characteristics of trends, and all

about how to pick an up trend. If you can

spot a trend, and ride the trend, it is possible

to be profitable.

But you need to keep a good stop-loss

in place.

See Brainy's "3Ways

Rule" for details about trends.

**

-

More trend-spotting details here.

Emotion and psychology

The day-to-day and week-to-week performance of

companies in the share market depends on the

underlying mood and sentiment of all the investors

and traders who participate in the market. When a

company's share price rockets upward, or dives

downward, it is because enough of the market

participants have a strong enough view of the

stock, or of the market generally, to cause the

share price to move. That is, the emotions and

opinions of market participants move the share

prices, and these are summarised in the price

charts.

See more details about the emotion and psychology

drivers of the share markets.

Which shares to

buy?

Some people follow fundamental analysis, and buy

shares in a company because they think they will

go up in price. But

is

this sensible?

Some people buy shares based on the price chart

alone - if the price is trending up, then they

ride the trend because "the trend is your

friend". This is based on Technical Analysis (also

known as charting). There is a long list of eBook

pdf

Articles on Technical Analysis.

And some people go for a bit of both - we call it

Funda-Technical

Analysis. The first part of this strategy is

all about choosing stocks from a list of quality

companies. Stocks with a proven history of

returning value on the shareholders equity, and

which are not over-geared, and which are also

likely to have improved earnings in the months

ahead. More information in the eBook Article ST-2300

(MA*).

Your stock universe

If you have decided to trade or invest in shares,

how do you decide which ones to focus on? This is

important because of the 2000+ shares on the

Australian market, many people decide not to buy

many of them for one reason or another. It might

be due to a lack of liquidity, or "old world"

stocks, or micro-cap stocks. Whatever the reason,

it is very useful to give this some thought.

Read

more on the "Your stock universe" web page.

Support and

resistance

The two terms support and resistance basically

refer to price levels on a price chart where the

share price has paused in the past, and where it

might be expected to pause again in the future.

These features are simply a reflection of the

views and opinions of market participants

regarding the perceived value of the company's

shares.

** - Read more here...

Exit strategies

The long-term buy-and-hold investor rarely

contemplates selling an investment position.

However, the astute investor/trader who wants to

protect capital and capture profits carefully

considers the possibilities for exit strategies,

and ruthlessly implements the chosen strategies.

**

- Read more here...

Stop

Loss! - How to minimise losses

The humble Stop Loss can help us

enormously to limit any losses, and thereby

protect our hard-earned capital. This includes the

notion of an Initial Stop, and a Trailing

Stop.

But what is this thing, and how do we calculate a

Stop Loss?

** - Read

more here...

Stock liquidity -

avoiding illiquid stocks

If you are serious about protecting profits, and

utilising techniques like a Stop Loss, then you

need to be confident that when you decide to sell

your stock there will be a buyer there to buy it.

Some stocks trade only a few times each day, or

worse still, a few times each week. This is not

the sort of stock that we want to be holding.

Learn more about stock liquidity, and what the

consistently successful traders and investors do

in this regard. See

more details here.

How to maximise

profits?

There are two opposing points of view about

profits, and how to maximise them. Some people set

a profit target which might be an arbitrary

percentage amount above the current price - say

20%. By selling out here for a profit, it is

possible to keep the profit, but potentially miss

out on a much larger profit.

Some people prefer to "let the profits run". By

maintaining a sensible Stop Loss, and monitoring

the position, it is generally safe (but not

always) to let the profits run.

Above

all - have a plan and strategy

It is very important to have a documented

investing / trading plan, and one or more

strategies.

See more

details

about plans and strategies...

|

Risk management

There are a number of important considerations

under this rather general heading to do with the

following topics:

- Money can slip away - brokerage,

commissions, slippage

- Good money management rules:

- Proportion of capital in any one position

- The 2% Rule

- Position size optimising

- Exit

strategies and Stop

loss.

See

more information about Risk management... |

Share "trader"

or share "investor"?

Are you "carrying on a business of share

trading"? (in ATO terminology)

Are you a "share trader" or a "share investor"?

This question often arises, and there is much

published on this topic. The actual and precise

distinction might get down to semantics such as

your desire to "own a part of the company", as

opposed to temporarily owning an item which you

can soon sell for a profit. Many books with

slightly differing views have been published.

Technically, a share investor typically

holds shares for a longer period of time, and pays

capital gains tax on any profit (or claims a

capital loss on losses). On the other hand, the share

trader typically holds shares for the short

term with no consideration of the impact of

capital gains, and might be happy to pay income

tax on the profits.

However, the Australian Taxation Office is the

body in Australia that will decide whether an

individual is an "investor" or a "trader", and how

any profits will be taxed (and how any losses

might be dealt with). The defining criteria

are not clear.

See the Australian Taxation Office web

site and more details with this Google search.

Online share trading and

investing

These days, trading or investing online is all the

go! But there are traps and pitfalls. Who can you

trust? See the comments at right.

Without proper preparation, the trading/investing

journey can be a very short one. Many people

embark on trading or investing with little

preparation, on the understanding that it is easy,

and that the profits will flow. But the truth is

that it is not so easy.

Proper planning and preparation includes a good

Trading Plan, and a sound and tested Trading

Strategy. Without this, you might as well be

gambling. More information about plans and

strategies is included in Robert's Articles.

Also see the section above on getting

started, and ask yourself if you are really

Share Market Ready? Take a look

at Robert's

Share-Market-Ready checklist.

Who can you trust?

While some operators are very trustworthy, there

are some who are only concerned with emptying your

wallet.

Here are some

good

questions for your financial adviser or

stock broker.

Fads will come and go, and hype will sweep through

the markets. And people will get swept up by a

range of promises. There are many claims "it's

easy", "make money in your spare time", "fulfill

your dreams".....

But, beware of the sharks in the ocean!

|

Seminars and workshops

Robert periodically runs seminars and

workshops to explain the share market

and how it works. His Share Market Secrets seminar

(aka Boot Camp) is a good

starting place. Or his Blue Chip Price Chart

Secrets seminar (aka Technical

Analysis/charting introduction).

Why does Robert run seminars and workshops for a

living?

and not stick to share trading? Here

is

the answer...

A quick word about some of the other courses and

seminars, especially the free ones. Some of these

trainers are touting a specific product, or an

expensive follow-up training course (without

naming any). So take care. By all means go along

to the free ones - nothing ventured nothing

gained.

|

More

information

Good

Books - There are many books available.

Here is a short starting list, and a plug for a

good book shop.

Robert's Share Market Gems and

cliches - Robert has compiled a list of

useful cliches and snippets of useful information

about the share market. It has taken a few years

to learn all this, but it is summarised here for

you.

How about a Sensible Approach to Sensible

Investing? Now, is that a good idea? Have

you seen a sensible approach lately?

Are you ready for the next Bear Market?

They come around faster and more often than we

care to admit. Robert has prepared some notes

entitled "Beware the Share Market Bears! -

They are never far away".

Are you Share Market Ready? Take a

look at Robert's

Share-Market-Ready checklist.

Interested in share price charts,

and how to read them?

Take a look at some charting software (like

BullCharts), or

consider learning about Technical Analysis (ie.

charting).

Also consider joining the Australian

Technical

Analysts Association (ATAA).

Interested in seeing more eBook Articles

about the Share Market, and Share Trading? Details

are

here...

Share Market Toolbox -

More

information

about Brainy's Share Market Toolbox - a great

collection of useful articles, eBooks, charts,

tools, commentary and web links to advance your

understanding of the share market, no matter

whether you are investing or trading.

How to

become a Toolbox member - Information

about how to become a Toolbox Member.

|

|

Brainy's Share

Market Toolbox - an arsenal of weapons to

help you tackle the market.

Brainy's Share

Market Toolbox - an arsenal of weapons to

help you tackle the market.

Investing

in cyclical stocks?

Investing

in cyclical stocks?