Introduction

Since the GFC (2008+)

many investors have come around to seeing that there is some merit in

utilising technical

analysis; but perhaps they struggle with understanding how to

make

a start. The information below works through some of the basics of

technical analysis, and some simple implementations. But first we

consider why this is so vitally important.

Why is this important and useful?

Firstly, it is

important to understand that:

Price charts summarise the

underlying opinions and emotions of the market participants.

Every chart tells a

story. It

pays to

understand the stories in the price charts.

This is important

because if a company's share price is tending to rise over time (an uptrend), it tells

us that there is an imbalance of supply and demand. That is, there is a

greater demand for the shares than there is supply. For anything, when

there is enough demand, the potential purchasers will try to outbid

each other in order to secure a purchase. In bull market conditions,

many stocks experience greater demand than supply, and so the share

price rises. And this is captured in the price chart. The price chart

has a story to tell us, and this can be very useful if only we know how

to interpret the stories in the charts.

Therefore,

at the simplest level we can find a stock with a share price in an

uptrend, and we can buy a position and join the trend. Then when the

uptrend is ending, we can sell the position to lock in profits and

protect our capital from any possible downside. In the material below

we look at the concept of a share price trend, and look at the

idea of a Stop

Loss and Exit

Strategies.

However, as we

proceed here, it is important to clearly state that we will usually

miss the very start of a trend, and the very end. So we should not go

looking for a turning point in anticipation of a possible uptrend -

this is wishful thinking and speculation.

Step 1 - Find stocks in a rising price trend

The first challenge for

everyone in this game is to find a good investment candidate. One

approach is

to find a

stock in a rising trend, and to join the trend. This is because the

experts say

that the "trend is your

friend". The only problem is that not every uptrend is

going to be profitable. So we need to have a plan to close a position

that is turning against us - an Exit Strategy.

However, being able to find an uptrending stock is very handy, and

there are many ways to do that.

About price trends on the charts

The first notion to understand is the idea of a price

trend - both the uptrend

and the downtrend.

This is important because once a trend

is confirmed to exist, then it

is likely to continue. This is because of the way the markets work, and

the

ways in which market participants take part in the buying and selling

process in the markets. It's also

to do with the investing/ trading emotion

and psychology.

How to

identify an uptrend or downtrend? - There are several ways

to do this. Some people suggest that in basic terms, if the share price

runs across the chart from the bottom left corner to the top right

corner, then an uptrend must have been in place. However, a

key approach used by technical analysts that is both precise and fairly

simple is described in the following paragraphs.

Uptrend

- Look at a simple line chart of a stock (like the sample shown at

right). It could be a daily* chart, or a weekly* chart, or in fact any

time period. On the price chart, an uptrend

is defined as a

series of Higher Peaks and Higher Troughs. To do this in practise,

first identify a peak on the chart, and then look to the right for a

higher peak. Likewise, identify a trough after the first peak, and look

for a higher trough (note: it does not matter whether the first peak is

before or after the first trough, because the important point is to

identify the next peak and trough). A downtrend is

defined

as a series of Lower Peaks and Lower Troughs.

Once an uptrend is in place, it is likely to

continue. That means that if we identify a stock with a share price in

a rising trend (an uptrend), then we could buy into the stock and it is

likely to continue rising (not guaranteed to keep rising, but is

likely to continue rising). If it just happens that the uptrend is

about to end, then we need to implement our exit strategy without delay.

Beware! -

Trends don't last forever

- It is important to understand that a price trend will not last

forever. So at some point it might be very appropriate to reduce a

position, or even sell out of

the stock completely. It is very important to be clear about the

conditions that

might trigger a sell decision - an Exit

Strategy.

Before we enter a position, we do have to be clear about the exit -

more details below.

|

|

An uptrend

- A sequence of

Higher Peaks (HP) and Higher Troughs (HT)

(click on the image for a larger version)

* About daily

and weekly price charts.

A daily price chart (like the sample above) shows

the close price at the end of every trading day,

all joined together with short straight-line

segments. It is normal to only show the trading

days - normally Monday to Friday each

week, and with public holidays not shown.

A weekly price

chart shows the close price at the

end of each week, all joined together with short

straight line segments. A monthly price chart is likewise. And none of

these show any detail about

the range in share price during the period (during

the day, week or month).

A candlestick

chart shows the range in price during

each period - during each day, or week, or month.

See some

deatisl about candlestick charts.

|

Example uptrend -

The chart at right is a weekly line chart of Commonwealth Bank (CBA)

showing a Trough in September 2011, followed by a Peak in October, then

a series of Higher Peaks (HP) and Higher Troughs (HT). The green line

sitting under the price is the uptrend

line, with all price action sitting above

the line to confirm the uptrend. However, the share price fell below

this line in April 2012 indicating that the uptrend had finished.

[By definition, an uptrend

line sits under the price action, and is touched at least

twice but preferably three times by the price line.] |

|

|

Downtrend

- The next image at right is a simple weekly price chart of National

Australia Bank (NAB) from its peak of about $43 in November

2007, to its low of about $17 in March 2009. In this chart, note the

sequence of lower peaks with one exception from March to May 2008 (this

is about a third of the way across the chart, and when

most of the stocks in the market rallied for about 8 weeks).

We have said above that once a trend is in place, it is likely to

continue. So once a downtrend

is confirmed (the first Lower Peak and Lower

Trough), it is considered likely to continue.

** WARNING **

Anyone

who suggests that

a stock in a downtrend

is a buy, should be asked for a money-back guarantee that

it won't fall further. If a stock's share price seems to be cheap, and

a downtrend

is still in place, then the price might get even cheaper. Buying a

stock whilst it is downtrending in the hope that the price might soon

rise is only wishful thinking. Some professionals will suggest that

dollar cost averaging will allow you to average out the costs; but this

in an absurd idea, because an uptrend or a downtrend is likely to

continue until it is confirmed to be over. If a stock is downtrending,

the downtrend might continue for a long time, and the price might fall

a lot further. This even happens to some blue chip stocks - see

the disappointing details.

See

more about price trends.

|

|

A downtrend

- A sequence of

Lower Peaks and Lower Troughs

(click on the image for a larger version) |

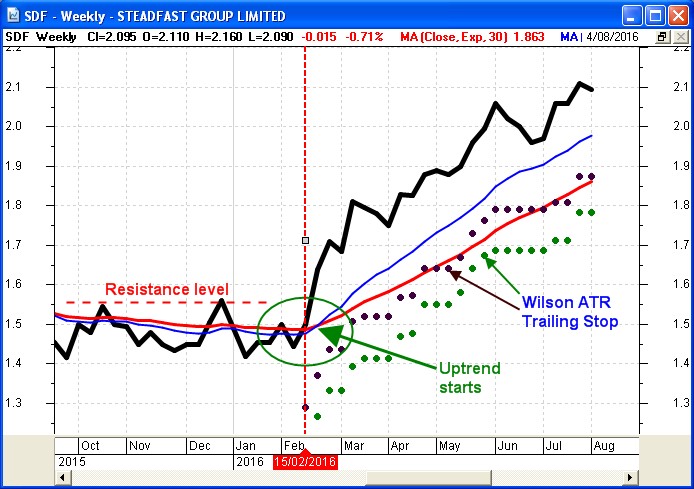

Case Study example - SDF

The price chart below is a good example of an uptrend. Note the key

points below.

Weekly price chart of SDF in an uptrend

Weekly price chart of SDF in an uptrend

- This is a simple weekly line chart. The thick black line shows

the close price each Friday, each one joined to the next one with a

short straight line segment. (It does not show anything about the range

in price during the week.)

- Almost the first half of the chart

(until the vertical red dotted line) indicates the share price trading

up and down but within a finite range. There are two peaks at about

$1.55, indicating a weekly resistance price level.

- From about

the date of the vertical red dotted line the price has taken off and rallied

higher with a series of higher peaks, and higher troughs - an uptrend according to our definition.

- The

red and blue lines are Exponential Moving Averages (EMA). The red one

is a 30-week EMA, and the blue one is a 15-week EMA. Note that they were

basically flat (horizontal) across the first portion of the chart. The

share price jumped above them in early February, and the two EMA curves

turned upwards and rose consistently higher. This is very relevant to Stan Weinstein's teachings.

- The

two sets of dots that rise across the chart are the Wilson ATR Trailing

Stop chart indicator (more on Stop Loss and Trailing Stop below). The

idea with the first set of dots (the dark coloured ones) is as follows:

"if the share price falls to the price level of this dot in the next

week, then this is an exit signal".

|

Step 2 - Invest wisely

If we want to invest wisely, there are a few key points to consider,

all of which ought to be planned out in advance:

- Don't

buy shares in a confirmed downtrend, because the downtrend is likely to

continue until it is confirmed to have ended (this is one of

the six tenets of Dow Theory).

- Use clever risk and money management, by not

putting all eggs in the one basket. And consider the topic of position

sizing. See

more about risk management in the markets.

- Have an Exit

Strategy already planned.

Step 3 - Protect your capital

This is perhaps the

hardest and most challenging aspect. Once we have bought a parcel of

shares, it is important to consider protecting the capital from any

downside. A small drop in price might be okay, and it might be the

normal part of

the daily and weekly cyclical moves of the share price. However, a

significant price drop is perhaps something that we don't want to

tolerate.

If we subscribe to the idea that a stock which

has turned and is now in a confirmed downtrend that is likely

to continue, then we

really want to close the position to limit any losses. [Note:

If we have a good exit strategy, and we have small losses and larger

profits, then we might still be able to be profitable with a win loss

ratio of 4 to 6 - that is, 4 wins to every 6 losses can still be

profitable.]

To

achieve this means utilising a pre-determined exit strategy. Just one

possible approach is a Stop Loss; but there are many ways to do that

also.

Do we really want to sell the shares?

What's wrong with holding the shares for a long time? Why can't we

simply buy and hold any more?

Why do we invest in the share market? Because we enjoy it? Or because

we want either short term income from dividends,

and/or capital growth? The reality here is that if we want to

increase our chances of being profitable, then we have to accept that

some shares will fall in value, and can fall a very long way, and that

some of these might never recover. Don't forget, when we lend our money

to a company by buying their shares, we are doing this on the basis

that we can take our money back at some stage in the future, and see

some appreciation. Otherwise we could be better off with our money in

the bank earning interest.

A range of different circumstances can cause a company's shares to

suddenly be over-valued, and to experience a mass of sellers wanting to

sell the stock. An excess of supply with declining demand will result

in a falling share price. Do we really want to be nice people and allow

the company to devalue our shares? Or would we rather cash them in and

protect our capital from further falls?

To achieve this, many investors need to adjust their investing

mind-set. Many investors need to be comfortable that there might be a

day when it is in their own interest to sell their shares.

|

Step 4 - Consider a Simple Stop Loss

A simple Stop Loss is a common tool used by many traders and

investors to

identify a weakening share price and to give a very clear signal that

an exit might be prudent. It can be explained as follows. There are

many ways to determine a Stop Loss value.

By way of example, the daily price chart below shows an uptrend for CBA

from November

2012

into April 2013. This uptrend is distinguished by a series of peaks and

troughs, but the alert observer will also see that between some of the

peak/trough pairs there is actually a sequence of lower peaks and

troughs (ie. a downtrend). This touchs on the topic of trends in multiple time frames

(which we can't stop to discuss here, but the link provides more

information for subscribing

Toolbox Members). However, do take a look

at the short horizontal lines on this chart. The green ones sitting

under the price action are potential levels

of support, and a good

place to set a Stop Loss level (see

more details about Stop Loss).

CBA and a series of Stop Loss levels

These Stop Loss levels are placed on the chart once we can see that a

clear trough has developed. If the price subsequently falls back to

this price level, and continues below the level, then we would sell.

For instance, near the start of this chart, the first horizontal line

and label "1" indicate a trough in the price at about $58 in November.

Going forward, if the price fell back to this level, we would sell. As

the price continued higher into January, and then fell back to about

$61 to form another trough, we would have scrapped our previous stop

loss level of $58, and adopted the level of about $61 as the new stop

loss level. And so we would continue as the price rose over time.

In this text we keep saying "a stop loss level of about...". It is

important to set your actual stop loss level a little under the last

trough in the price, because many less experienced investors will also

have a stop at a similar level. And when the price falls they will all

close their positions. But the short term trading desk professionals

all know this, and they know they will be able to pick some stock at

these levels, before the price continues to rise. Remember that once

all of the available supply is gone, the price will have to rise. So be

careful not to get caught out, and do have your stop loss a little

lower so as to be utilised with a genuine falling share price.

Initial Stop versus Trailing Stop

Just to clarify some terminology, the first Stop Loss line on the

simple example above would be consider the initial stop loss value,

and all the other stop loss levels at higher values in this price trend

are referred to as trailing

stop loss values.

|

|

Trailing Stop using a chart indicator

Without

trying to explain too much about it here, the charts at

right are some more examples

of a Stop Loss (actually a Trailing Stop Loss).

In these examples,

the sequence of heavy dots that rises across the chart under the share

price is the stop loss value. The way to read it is that if the share

price in the next period falls to the level of the dot, then we should

sell. We can see in the second example that the price has fallen below

the dots towards the end of the chart so that a sell signal was given.

In both charts here, the row of dots running across and up the price

chart is the Wilson ATR Trailing Stop chart indicator (available in

BullCharts software and others). It is based on the Average True Range

(ATR) calculation, and does not fall on the chart. It is just one of

many chart indicators that are available for this purpose.

|

|

|

|

Step 5 - Consider other exit strategies

There are many ways to determine how to decide to exit a position. One

of these is shown in the sample chart at right.

Sample at

right - The example chart at right shows CBA's weekly

share price in October to December 2007. On this chart a dotted

horizontal red line above the price action indicates a likely resistance

level

- a price above which no one is prepared to buy the stock at

this point

in time. The rising blue line across the chart is a Moving Average

(MA). The observations we can make are as follows:

- The

share price made a "peak" in the week of 29 October.

- Over the following weeks it failed to

move

higher than that peak, indicating a possible resistance level. The

price peaked in the two weeks commencing 3rd and 10th December , then

fell in the following weeks. This confirmed the Lower Peak (indicated

on this chart as "Lower high"), which confirmed the end of the uptrend

that had been in place.

- By early January the MA curve had flattened,

and the share price had fallen below the MA. According to Stan

Weinstein*, this is a classic sell signal

* - "Secrets for Profiting in Bull and Bear Markets", 1988, Stan

Weinstein.

See more information about Exit

Strategies.

|

|

|

Step 6 - Implement and action your exit strategy

Okay, so you have an exit strategy written down so that it is clear in

your mind. That is, when the specific condition that you have described

occurs, you can action your exit without a second thought. This is most

important. The first loss is always the smallest. Remember that we can

be profitable with a win to loss ratio of 4 to 6 (ie. 40 percent of

trades are winners), provided the losses are small and the wins are

large.

But, how do we know when the share price has triggered our exit

condition? If we are using a simple stop loss, and we have determined

that if the share price falls below a particular value, how do we know

when the share price actually falls to this level? We don't want to

spend all day watching the share price. Here are a couple of methods:

- For an End of Day (EOD) investor, the charting

software can be used to implement an alert, and then after you download

the latest EOD data the software can flag the stocks where a particular

price level has been triggered (eg. BullCharts

software can do this).

- If you would like a simple way to know as soon as a

share price has hit a particular level, then utilise the alert tools

that your online broker offers. For example, if CommSec is your online

broker, they have an alert service where you can easily set up an alert

so that if a share price hits a specific level, their system can send

you either an informational SMS message and/or an email.

There are many ways to make the final decision as to whether to exit

now, or wait for a second signal of some form. It is important to have

thought through the process and have it clear in your mind.

Summary

In the information above we have looked at some of the simpler ideas

regarding technical analysis, and some of the straight forward ways in

which we can utilise technical analysis. However, this is only the

beginning, and there is a lot more to technical analysis than what is

shown here. There is so much to this subject that a successful

technical analyst only needs to use a small amount of it. There is no

need to understand everything about the subject. The secret is to learn

just enough.

Good luck with your investing / trading, and watch out for the sharks

in the ocean.

More details...

For more information about breakouts, and more samples from which to

learn,

refer to the eBook

Articles in the Share Market

Toolbox - see the links at

top right.

|

More

Information

For more information on

technical analysis, refer initially to Brainy's pages on TA, and then

refer to the ATAA

web site, or the IFTA web site.

Robert writes information from time to time about

the market and investing. If you are not a

Toolbox Member, you

can

register to receive useful free information as it is published.

Privacy ensured, unsubscribe anytime.

See

the Testimonials - the things that people say about the

Toolbox and more.

|

Terminology

Any special terms that might be used in the text at left, can probably

be found discussed in the Toolbox somewhere. Perhaps

in Brainy's eBook Articles - see the Master

Index list for details. Or, search

the eBook Articles.

The

Share Market

- more information about the market and investing and trading.

The toolbox is an arsenal

of weapons to help you tackle the share market.

See a list of contents on

the Toolbox

Gateway page.

Robert

Brain provides support to both new and

experienced traders and investors.

Who

is Robert Brain?

And whatever you do,

beware of the sharks

in the ocean!

|